Annual Contract Value - what is it?

Annual Contract Value (ACV), is a valuable but largely misunderstood metric that caters to businesses following a subscription model or any contract-driven industry. This KPI is helpful in providing businesses insight into the health of their product offerings and customer reception.

However, like with many KPIs that involve multiple variables, there is no consensus on how to calculate the metric. We’ll explain the versatility of this metric and clear up the confusion around the usage of ACV in SaaS and other subscription-operated industries.

What is Annual Contract Value (ACV)

A lot of decision-makers don’t see the upside of trading ACV because of its similarity to Annual Recurring Revenue (ARR). However, ACV differs from ARR because it spreads out revenue across a long-term period, rather than at a singular point in time. This aspect of ACV allows decision-makers to track revenue trends over the long run and improves predictive capabilities.

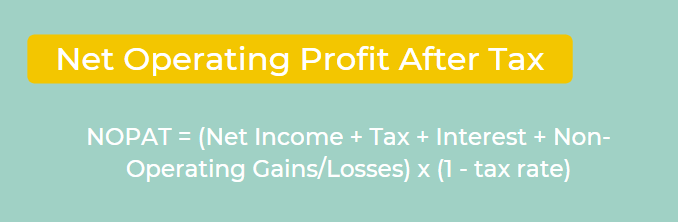

How to Calculate ACV

There are two main examples in which ACV differs in calculations: long-term and short-term customers. We’ll expand on how they differ and why calculating both may be helpful to any firm.

Long term ACV

Customer 1 has recently signed a 4-year contract for $70,000 to use your software, with a sign-on fee of $300. The contract includes yearly payments.

This is how we would calculate ACV for Customer 1:

- $75,000 / 3 years = $25,000 (ACV)

In this example, ARR and ACV are the same, calculating the value of the contract at one point in time. However, in the short term, ACV differs from ARR.

Short term ACV

Customer 2 also closes a deal with your company, agreeing to a 6-month deal worth $8,000. The client agrees to a monthly payment plan. However, since payments are normalized over a minimum period of 1 year, ACV would be calculated as follows:

- $8,000 / 1 year = $8,000 (ACV)

Combining the Short and Long-term

When combining Customers 1 and 2, these calculations begin to show why ACV is a crucial tool to any finance professional. Let’s compare the ARR to the ACV of both customers:

- ARR

$25,000 (Customer 1)

$8,000 (Customer 2)

- ACV Year 1

($25,000 + $8000) / 2 customers = $16,000

- ACV Year 2

($25,000 + $0) / 1 customer = $25,000

In this example, you can see how the averaging of value that ACV calculates can help you distinguish your firm’s long-term financial health, which is vital to businesses employing a subscription-based model.

Why Use ACV?

No KPI is revolutionary standing alone, with other metrics contributing to a wider vision of a firm’s financial and operational stability. By pairing ACV with other metrics, decision-makers can extract vital insights to optimize strategies.

Firms can be profitable with both high and low ACVs, however, the importance of churn rate and CAC help determine whether a company can actually sustain its operations with its current and expected ACV.

For example, music streaming platforms like Apple Music or Spotify can sustain a lower ACV due to their low CAC. On the contrary, a firm such as Toucan, which has a higher CAC, cannot survive with a low CAC due to onboarding and support expenses.

These metrics, paired with ACV, are crucial to determining the correct benchmarks for a business’s financial health. By setting the correct benchmarks, decision-makers can optimize their funding of marketing and sales channels to leverage all of their resources in an efficient and profitable manner.

Tracking ACV

Although measuring this KPI can serve as a powerful insight generator, accurately tracking this indicator over a long period determines success. Since ACV is dependent on other indicators such as CAC and churn, it is vital to construct dashboards that display your firm’s progress in real-time.

A data visualization tool like Toucan can aid a firm’s financial tracking efforts by catering to users with little data experience and enabling collaboration through the usage of cloud technology. The ability to track ACV, CAC, and churn in real-time on any device allows for full ownership of a firm’s data across multiple departments.

With a new generation data visualization tool, ACV becomes a valuable tool for subscription-based businesses looking to focus on regaining financial health.