In an era of heightened social awareness and emphasis on social responsibility, Environmental, Social, and Governance (ESG) reporting has gained traction for firms seeking to satisfy shareholders and customers. Many organizations are reforming their business operations and practices to maintain sustainability, reduce damage to the environment, and positively impact communities.

ESG has become a buzzword in the corporate world, with many corporations identifying it as a synonym for sustainability. However, this aspect of a corporation’s reporting is a lot more complex and important than a general measure of sustainability, with investors trusting companies who abide by the most thorough ESG practices. Reporting ESG metrics is the best way to visually present a firm’s efforts to potential investors.

What is ESG Reporting?

ESG reporting focuses on three major aspects of company data:

- Environmental

- Social

- Corporate Governance

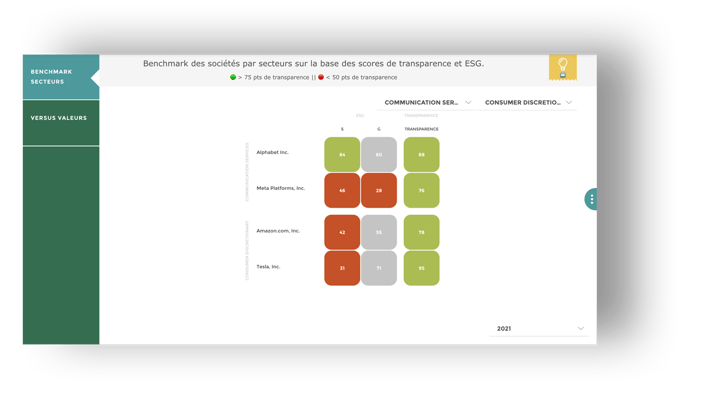

These three aspects of ESG reporting aim to provide company transparency and metrics to display presence of robust social responsibility initiatives. By providing official reports backed by data, a corporation’s ESG initiatives become concrete, rather than abstract, empty promises on a slideshow presentation.

Corporations like Starbucks have answered the call to initiate robust ESG initiatives, releasing yearly reports on statistical progress towards environmental and social goals.

However, most corporations still have not harnessed the full potential of ESG reporting. We’ll break down how an embedded analytics platform like Toucan can provide detailed, but simple visuals to elevate a firm's ESG reports.

Lacking Standardization

The main problem with ESG reporting is that official standardization is lacking for KPIs. Although the European Union has adopted certain measures to track KPIs in its governance initiatives, global powers have not yet implemented a mandated ESG framework, with each government and corporation tracking aspects of ESG that fit their agendas.

![]()

Although there is no set process for reporting ESG metrics, tracking the most meaningful and relevant ESG KPIs is an invaluable asset for any business. With ESG initiatives and reporting varying by country and industry, current corporate practices call for a more thorough and unified approach to solving sustainability weaknesses.

With the onset of the COVID-19 pandemic, an alignment on ESG initiatives was necessary to protect the employees and the public, with 50 attendees of the Sustainable Development Summit 2021 agreeing to include Stakeholder Capitalism ESG metrics in their reporting. These metrics allow firms to compare ESG metrics through a unified framework regardless of geographical location. For example, some of the companies adopting this ESG framework include:

- Bank of America

- Zurich Insurance Group

- UBS

- Unilever

- Siemens

Most importantly, unified ESG reporting is gaining traction among some of the largest corporations. Although there are no set metrics that are required by law, the firms with the most robust ESG reporting will instill increased confidence in investors and consumers, and most importantly, create frameworks that translate to future mandates.

These initiatives, paired with ongoing research by independent organizations and growing pressure on governments to implement stringent environmental protection laws foreshadow a mandated, uniform framework for ESG reporting in the near future.

Here are the general areas of reporting we believe every corporation should practice maintaining transparent and thorough ESG reporting to integrate this practice before mass adoption. We’ll discuss the important aspects that each corporation should cover in their reporting and explain the usefulness of data visualization in maximizing data presentation.

Environmental Reporting

Carbon Footprint

Many corporations have initiated the reduction of their global carbon footprint globally to match progressive government legislation and reduce pollution caused by company operations.

With an embedded analytics platform like Toucan, firms can report their environmental initiatives as a data story, comparing goals or benchmarks with statistics to convey strengths or weaknesses across the globe.

Exposure to Climate Change

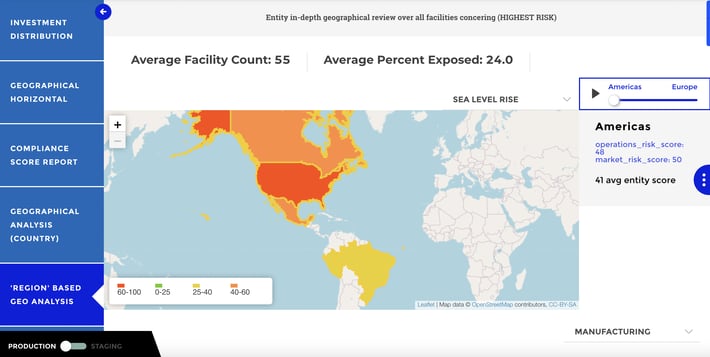

With the effects of climate change impacting every individual globally, firms can utilize embedded data stories to view areas in which environmental initiatives must be strengthened. In this example, Arrhenius Foods’ 29 facilities have been affected by rising sea levels.

Sharing this information with shareholders and clients motivates executives and the budgetary department to allocate greater resources that reduce climate change and the probability of facility damage.

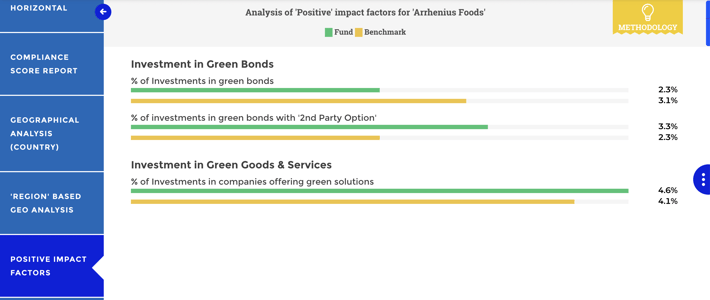

Green Investments

Although many firms claim to invest millions yearly into green initiatives, reports solidify their credibility. With efficient ESG reporting, firms can convey their investments into climate-friendly projects, comparing them to industry averages or government benchmarks.

In this example, Arrhenius Foods must shift resources from investments in green goods and services to investments in green bonds to satisfy benchmarks.

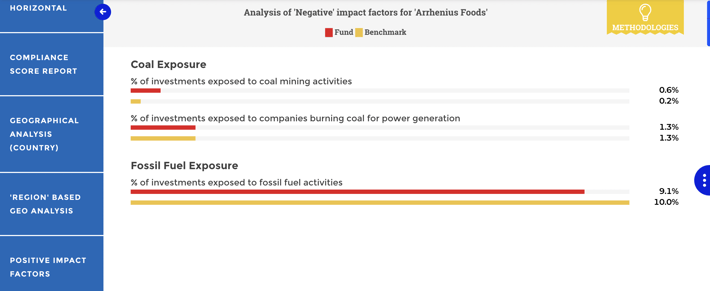

Negative Impact

Inevitably, a firm’s operational infrastructure will cause environmental damage or be exposed to other factors causing pollution. With effective ESG reporting, firms can identify which practices or external factors are the most environmentally damaging and allocate time and resources to eliminating pollution.

In this example, Arrhenius Foods’ infrastructure is more exposed to coal mining activities than the average firm in the industry. To remedy this exposure, the firm may reach out to mining companies to collaborate on initiatives to reduce the environmental damage caused by coal mining activities in the region.

Effectively Reporting Environmental ESG Initiatives

Although a firm may report these aspects of their ESG programs, reporting them inefficiently may confuse, deter, or undermine the importance and effort devoted to them.

Creating separate dashboards that are relevant to each set of KPIs is a must for environmental reporting, especially with so many areas requiring intense data tracking. Data storytelling is an asset to providing a lucid, concise, and clear narrative of a firm’s environmental protection efforts.

Social Reporting

Diversity Reporting

Firms are placing a greater emphasis on employee diversity. As of 2021, 57% of employees think their company should be doing more to increase diversity, and 41% of managers state that they are “too busy” to implement any kind of diversity and inclusion initiatives.

These statistics have driven a renewed drive to search for diverse talent, with many corporations such as Starbucks, Intel, and Google leading campaigns to attract minority employees.

Reporting employee diversity initiatives, as well as the number of minority employees at a firm can increase stakeholder confidence in the effort to create a more inclusive environment for workers.

Data Protection and Privacy

In light of many reports exposing the predatory practices of big tech that extract consumer data without their knowledge, firms have been implementing initiatives to calm both investors and customers.

For example, reports of data malpractice from Google, Meta, and Twitter, drove Apple to implement a new technology called Data Protection, which protects data stored on Apple Devices. The firm also includes robust encryption for its widely used iMessage, which increased social favorability with Apple’s data practices.

For tech firms, reporting on data privacy initiatives can calm public speculation on revenue-driven data collection practices, driving continued investment and consumer confidence.

Effectively Reporting Social ESG Initiatives

Although social ESG KPIs may seem less complicated to report than environmental efforts, the appropriate care must be taken to effectively display a corporation’s impact on the communities it affects.

Taking the time to carefully display every area of workplace diversity efforts, consumer health and safety, and equality is the difference between the public viewing your corporation as lazy or impactful. By organizing your KPIs by category into visually appealing dashboards, your firm’s social initiatives can be clearly identified and compared.

Governance

Corporate governance is the system of rules, practices, and processes by which a firm is directed and controlled. It balances the interests of a firms

- Shareholders

- Senior management

- Customers

- Suppliers

- Financiers

- The government

- The community

Corporate governance is also responsible for providing the framework to reach company goals, controlling every sphere of management.

Procedure and Compliance Reporting

Governance reports should include a transparent disclosure of the company’s governance procedures and compliance. These disclosure statements should also include codes of conduct that guide operations, as well as the power dynamic between the board chair and the CEO.

Board Composition

ESG reports should also include a detailed picture of executive management. Ideally, investors are attracted to boards containing 7-11 board members. Disclosure of the board’s demographic, experience, profession, and age can serve as a display of the company’s efforts to attract diverse talent that can contribute to multiple areas of company management.

Board performance, both individual and collective is also disclosed in governance reports. Throughout disclosure reports also display

- Independent mechanisms for efficiently and objectively tracking each member’s performance

- Procedures for replacing a leaving board member

- Potential conflicts of interest and how they are resolved

- Board development in the scope of growth

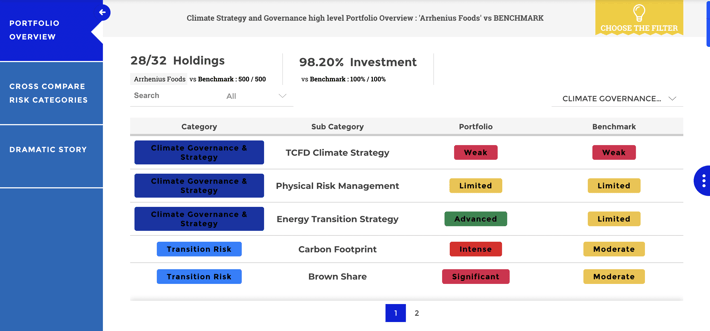

Effectively Reporting Governance ESG Initiatives

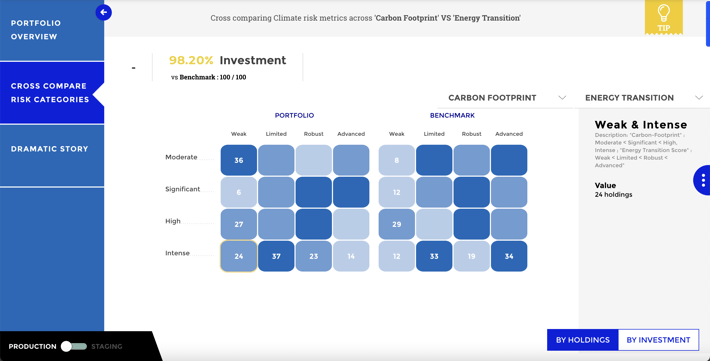

Governance reporting is arguably the most abstract pillar of ESG reporting, including many complex organizational structures and financial information.

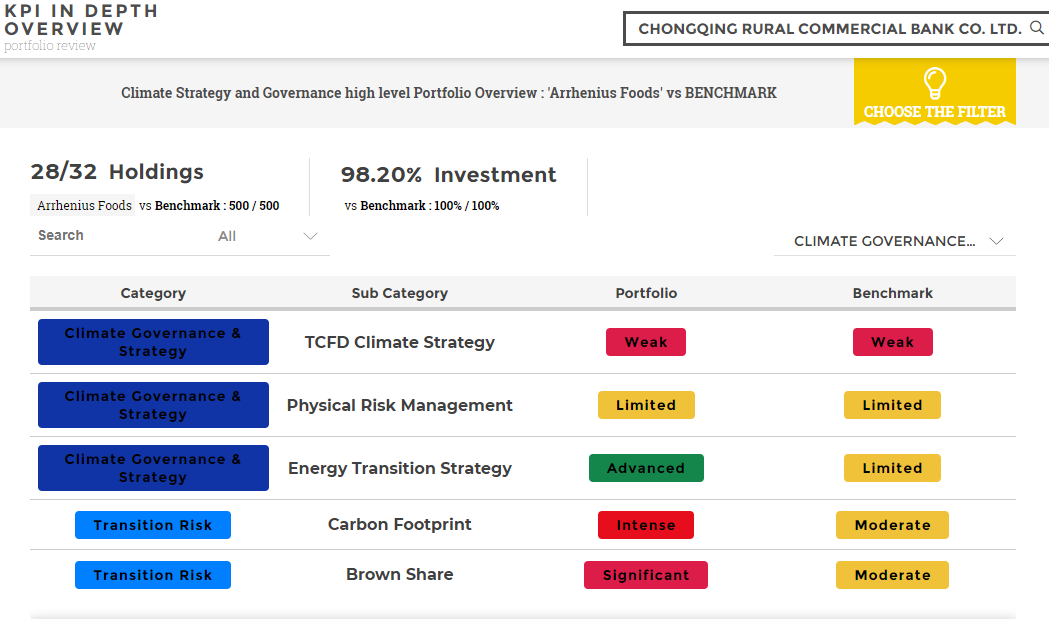

Take this governance dashboard, which displays a firm’s investment portfolio, as an example. It displays a firm’s complex investment benchmarks, categories, and status in an organized, understandable fashion.

Another solution to the complexity of governance reporting is a glossary defining terms for non-technical audiences, with data visualization tools such as Toucan providing this capability. By breaking down every category of governance into an organized visual representation, internal and external shareholders can easily grasp a firm's governance status.

Why ESG Reporting Can Grow Your Company

In the age of social media, transparency has become paramount for firms under the microscope. One hidden aspect of a company’s ESG malpractice can lead to social media controversies, causing plummeting stock prices and decreased customer confidence.

By utilizing an embedded analytics tool such as Toucan, your firm can display a data story of its ESG initiatives, tracking them in real-time over any period. Rather than waiting for quarterly ESG reports, firms can track their progress daily, on any device, increasing insights and allowing decision-makers to act on any weaknesses. Learn more about how Toucan can grow your management capabilities.