How Business Intelligence can Help Finance Professionals

.jpg?width=88&height=88&name=PORTRAIT_Baptiste%20(1).jpg)

Baptiste Jourdan

Publié le 11.03.22

Mis à jour le 13.01.26

4 min

Résumer cet article avec :

Organizations use Business Intelligence (BI) to collect, process, and present the extracted value from existing data. By using visualizations, reporting, predictive analytics, and other features, it turns data into a better understanding of what it holds for better business decision-making.

In financial analytics, business intelligence software provides the foundation and answers the "why" questions based on real data. By combining business intelligence and analytics, companies can see the journey from the present moment of information to data management, predictions, and future decisions.

Particularly for the finance industry, business intelligence tools and analytics are the instruments that help us to see the world clearly. What are the practical benefits of business intelligence software? Even though business intelligence (BI) has its own specific purpose for every financial services organization and the tooling is different from wealth management to investment to insurance to banking, there are some universal benefits of using BI and analytics in finance.

Benefits of Using Business Intelligence (BI) for Finance

It's not enough to juggle spreadsheets or rely on one-dimensional, basic reporting. You need business intelligence software. BI makes it possible to correlate and visualize large amounts of data across multiple sources to reveal financial and operational insights, allowing anyone in the organization to access them.

Let’s take a look at potential benefits.

-

Reduced risks

You can mitigate risk by tracking financial behavior and detecting fraudulent activities in near-real-time with BI tools. Monitoring employee behavior for compliance is also an option with BI tools. Furthermore, you can combine internal data with information on industry and market trends to analyze credit portfolios and detect any instances of delinquency. This is a proactive approach to reducing accounts payable risks.

-

Increased profitability

Retaining current customers is more profitable than acquiring new ones continuously. Marketing and sales teams can use BI tools to stay up to date with customers. Your most profitable and loyal customers can be targeted to market new products and services, upsell, and increase customer lifetime value. Additionally, they can use BI data to increase the profitability of customers who are less profitable.

Analytics can be used to monitor customer retention metrics, such as attrition rate, average order value, repeat customer rate, and purchase frequency. BI tools can also be used to collect product-specific information to determine where to focus R&D efforts, how to enhance services, and which product lines to put on hold to preserve margins.

-

Better communication

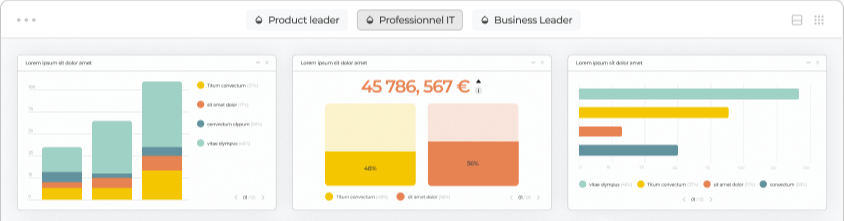

Role-based access to BI tools ensures that everyone has access to the same data at the same time. Instead of double-checking Excel spreadsheets or waiting for separate data source analysis, teams can tell better stories using a centralized data warehouse with role-based access and data-rich KPIs and visualizations.

-

Competitive edge

In addition to comparing your offerings to those of your competitors, BI can help you find ways to strengthen your position within a market. Banking and financial institutions are seeing exceptional benefits from BI tools that enable them to customize products by leveraging available data to gain a competitive edge. As well as monitoring market trends, this information can be used to plan new investments, predict customer behavior, and make sure existing products continue to meet customer needs.

-

Marketing profitability

Customer relationship management (CRM) data can provide insights into the ROI or profitability of marketing campaigns. With BI, you can track advertising spend, email marketing performance, and a campaign's overall success to determine where your organization's messaging is effective and where it isn't

-

Operational efficiency

Just as important as measuring the consumer experience is ensuring your organization operates efficiently internally. With business intelligence software, you can measure operational performance, how resources are allocated efficiently and how your employees perform compared to their peers.

Be sure to include HR teams in BI planning. In human resources, BI can be used to understand employee satisfaction, engagement, and productivity. Furthermore, it can be used to ensure the right workforce plan is in place to meet your future business objectives.

How Finance Is Using BI

.png?width=519&name=webinar%20listing%20(Making%20Digital%20Change%20Visible%20in%20Your%20Finance%20Department).png)

Business intelligence provides insights into internal and external factors that affect a company's bottom line. Listed below are a few dashboards and analysis categories that show the business' current state, trends, and problems.

- Planning and analysis: Dashboards for FP&A, budgeting, and forecasting support operational and strategic goals. Financial analysts often use BI tools to forecast how an organization will perform. Finance teams can analyze variances using data drawn from sources that provide insight into business trends, cash flow, historical data, scenario modeling, and variance analysis in order to compare actual performance with forecasts and determine why discrepancies exist. The CFO can now lead the way if there is room for improvement.

- Operations reporting: Dashboards like this provide a tactical view of business operations by gathering insights into the daily realities of running a company. CFOs can make rapid decisions based on operational reporting in BI systems because they provide detailed insights into current and short-term needs. The purpose of operations reporting is to provide highly granular information for making strategic decisions that benefit a company.

- Risk management: Leaders must react quickly to threats. BI and data management tools help the finance department track financial performance and monitor credit and market risk. Dashboards can be customized to display important KPIs front and center, allowing your team to see what matters most instantly. Furthermore, BI helps compile risk assessments as investment opportunities arise and respond to regulators if they require updated information more often.

- Expense reporting and management: Using dashboards and analyses, the finance department can gain a comprehensive picture of employee spending, enforce expense policies, and monitor T&E trends. You can use dashboards and reports to help managers monitor their employees, set up alerts and notifications to proactively manage spending, and connect BI tools to your company's expense, invoice, and online travel booking systems.

- Cash flow management: With BI, managers can automatically generate and continuously update AR and AP forecasts, making managing cash flow easier. Whenever there is a cash surplus or shortage, the organization can scale back or respond quickly to growth opportunities. Additionally, business intelligence can help companies analyze the duration and cost of major projects, become more deliberate when it comes to inventory spending and decide whether to go ahead with a merger or acquisition.

- Balance sheet management: As many finance departments use Excel for reporting, especially balance sheets, spreadsheets and financial reporting are often linked. Although spreadsheets can summarize a significant amount of information, they are not suitable for exploratory analysis. BI, instead, can find and analyze contextual information within operations, financial, and accounting systems and generate visual analytics. CFOs now have access to detailed variance reports and the ability to dissect and analyze balance sheet data.

- Revenue management: By using business intelligence systems, financial management, including revenue management, becomes more effective. An effective BI tool can help you decide when to sell, who to sell to, and what price to set. A centralized BI system enables dashboards to collect, interpret, and present data through key performance indicators, which helps teams formulate data-driven plans and predict customer behavior.

- Profitability management: Factors such as channel profitability, discount impact, lifetime revenue contributions for different groups are analyzed by BI systems. CFOs and other business leaders can use these insights to acquire and retain profitable customers. In the end, BI helps leaders understand how customer behavior impacts profitability.

- Performance improvement: In order to monitor performance metrics, including net profit, cash conversion cycles, and operating profit margins, financial KPIs are crucial. By delivering BI data, organizations can determine whether they will be able to achieve their targets.

.jpg?width=112&height=112&name=PORTRAIT_Baptiste%20(1).jpg)

Baptiste Jourdan

Baptiste is the Co-founder and Chief Revenue Officer (CRO) at Toucan, the embedded analytics solution designed for product teams and SaaS companies. With over 10 years of experience in tech and entrepreneurship, he helps businesses turn data into engaging, accessible experiences that drive real value. Passionate about making data truly actionable, Baptiste shares on Toucan’s blog his vision for customer-facing analytics, practical tips for successfully embedding dashboards into SaaS products, and insights on the future of user-centered data experiences.

Voir tous les articles