Cash conversion cycle (CCC) refers to the time it takes a company to clear its stored inventory, turn its unpaid bills into cash, and push back the date of payment to suppliers. A company that consistently monitors the CCC metric can identify and address any operational deficiencies related to working capital that reduce free cash flows (FCF) and liquidity. "Cycles" refer to the process businesses go through to purchase inventory, sell it to customers on credit (i.e., accounts receivable), and collect cash payments from customers. CCC is one of the important financial metrics a company should monitor.

Importance of Cash Conversion Cycle

CCC is an important metric because it can serve as an indicator of the efficiency of operations and decision-making capabilities of a company.

The main reason why net income does not accurately reflect the liquidity of the company is because of working capital, predominantly inventory accounts receivables (AR) and accounts payable (AP).

- Inventory: In the best-case scenario, the amount of inventory purchased and the type of products sold should be met with adequate demand from the market (i.e., there is no build-up of inventory that the company is encountering difficulty in selling.

- Accounts Receivable: For A/R, customers that previously paid using credit rather than cash are paying off their outstanding balance sooner. Despite the revenue being recognized (i.e., “earned”) on the income statement under accrual accounting standards, the cash has yet to change hands since the customers are delaying their payment.

- Accounts Payable: A/P increasing on the balance sheet suggests the company has “buyer power” (i.e., bargaining leverage when it comes to negotiating supplier terms), which enables them to delay payments – as the seller awaits the payment from the buyer, the buyer is then free to use that cash for a variety of other purposes

An increased cash conversion cycle means that the real cash flow profile of the company is further from how it is portrayed on the income statement. An upward trend in CCC would indicate potential inefficiencies in the business model, while a downward trend is a positive sign. From a cash management perspective, companies with lower CCCs tend to be better off.

CCCs are often low as a result of clearing inventory quickly, having the ability to negotiate with suppliers, and having payment collection processes in place that are effective at recovering cash from customers who paid on credit. CCCs that are high compared to the industry benchmark indicate that a greater proportion of the company's cash is tied up in its operations.

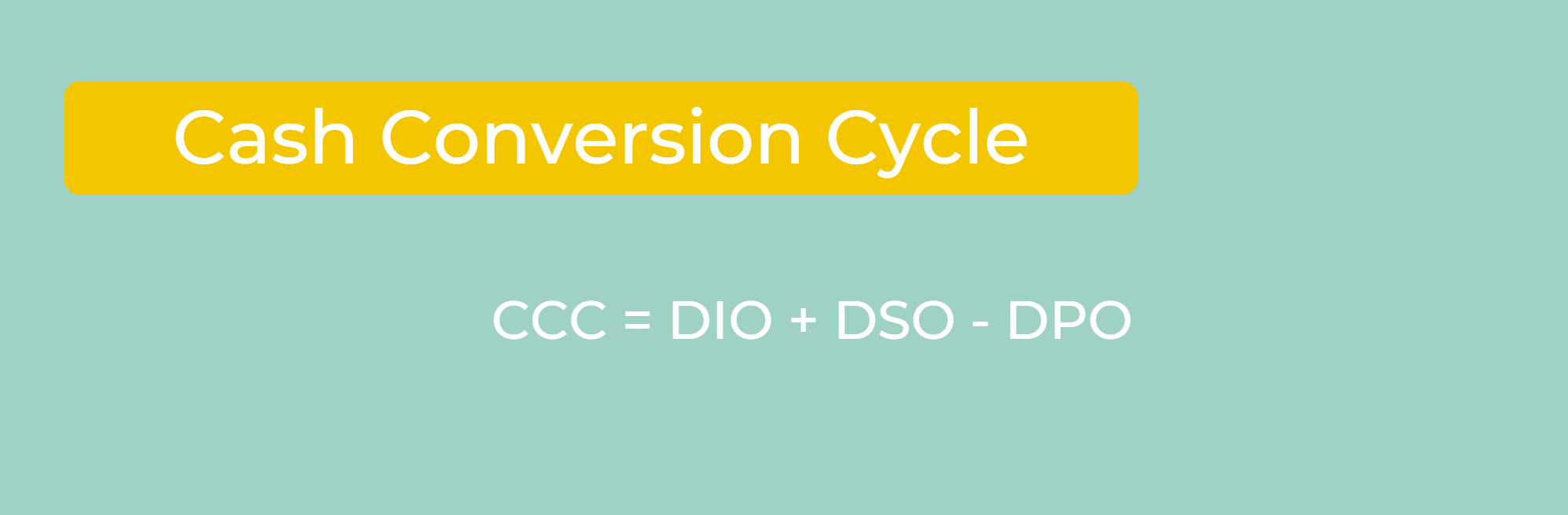

Calculating Cash conversion Cycle

.png?width=600&name=webinar%20listing%20(Making%20Digital%20Change%20Visible%20in%20Your%20Finance%20Department).png)

To calculate CCC, you need several items from the financial statements:

- Revenue and cost of goods sold (COGS) from the income statement;

- Inventory at the beginning and end of the period;

- AR at the beginning and end of the period;

- AP at the beginning and end of the period; and

- The number of days in the period (year = 365 days, quarter = 90).

Inventory, AR, and AP are found on two different balance sheets. If the period is a quarter, then use the balance sheets for the quarter in question and those from the preceding period. For a yearly period, use the balance sheets for the quarter (or year-end) in question and those from the same quarter a year earlier.

This is because while the income statement covers everything that happened over a certain period, balance sheets are only snapshots of the company at a particular moment in time. For AP, for example, an analyst requires an average over the period being studied, which means that AP from both the period's end and beginning are needed for the calculation.

Here is the formula:

- DIO is days inventory or how many days it takes to sell the entire inventory. The smaller the number, the better.

DIO = Average inventory/COGS per day

Average Inventory = (beginning inventory + ending inventory)/2

- DSO is days sales outstanding or the number of days needed to collect on sales. DSO involves AR. While cash-only sales have a DSO of zero, people do use credit extended by the company, so this number will be positive. Again, a smaller number is better.

DSO = Average AR / Revenue per day

Average AR = (beginning AR + ending AR)/2

- DPO is days payable outstanding. This metric reflects the company's payment of its own bills or AP. If this can be maximized, the company holds onto cash longer, maximizing its investment potential. Therefore, a longer DPO is better.

DPO = Average AP/COGS per day

Average AP = (beginning AP + ending AP)/2

Notice that DIO, DSO, and DPO are all paired with the appropriate term from the income statement, either revenue or COGS. Inventory and AP are paired with COGS while AR is paired with revenue.

CCC is not very meaningful on its own. It should instead be used to monitor and compare the performance of a company over time and with its competitors. The CCC over a period of several years can reveal an improving or deteriorating value. Additionally, CCC should be calculated for competitors as well.

CCC is most effective when applied to retail-type companies, which have inventories that are sold to customers. Consulting businesses, software companies, and insurance companies are all examples of companies for whom this metric is meaningless. The easiest way to keep a track of your CCC and your competitors is with a great financial analytics solution that can not only calculate your CCC but also provide content and actionable insights.