Net Operating Profit After Tax: All You Need to Know

Net Operating Profit After Tax (NOPAT) measures a firm’s income without any debt or interest expenses. This indicator is normally utilized as a comparison tool by removing the complex capital structures of businesses, simplifying the comparisons between two firms in the same industry.

NOPAT is often used interchangeably with EBIT and EBIAT and excludes tax benefits from holding debt. To simplify, NOPAT represents a firm’s operating profit, removing extra financial aspects such as interest expenses, and others that impact a firm’s tax payment.

Why Use NOPAT?

This KPI is essential to financial modeling, with financial analysts using NOPAT as the essential metric to calculate free cash flow that is unleveled. NOPAT is most commonly used by executives, moneylenders, investors, and shareholders.

Moneylenders use NOPAT to determine a firm’s true value, determining whether businesses can sustainably repay loans, while shareholders and investors utilize the KPI to determine whether a firm is a healthy investment.

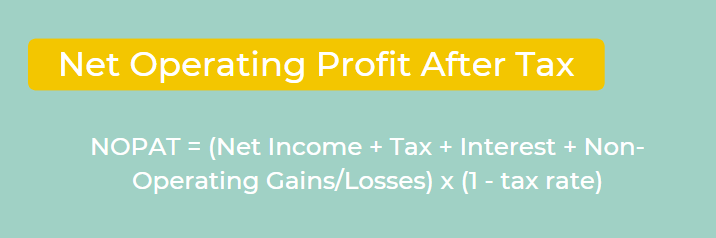

Calculating NOPAT

Let us take an example, we will use a firm whose EBIT is $20,000 and the tax rate is 25%. The firm’s NOPAT would be $18,750, after deducting the cost of taxes. If this firm did not have debt, its net operating profit after tax would be the same as its net income after tax.

By excluding the complexities of debt and expenses, analysts utilize this metric to compare firms against others in the industry, since different industries have a wide range of costs.

Another utilization of NOPAT by analysts is to calculate a business’s free cash flow to firm. Free cash flow to firm is a company’s net operating profit after tax, minus changes in working capital. These two metrics are most commonly used by investors and firms looking for acquisition targets.

How to Track NOPAT

In this new age of data, financial professionals who do not invest in their data stack are at an obvious disadvantage. With adoption growing for embedded analytics tools, firms are vying for success driven by precision, ownership of their data, and actionable insights.

An example of a data visualization tool includes Toucan, which can serve as a finance professional’s secret weapon.

With added functionalities of embedded glossary pages, mobile device optimization, in-app collaboration, and stunning dashboards, data visualization tools provide a simpler, more effective ownership of financial data.