Monthly Recurring Revenue, commonly abbreviated as “MRR” is all of your recurring revenue normalized into a monthly amount. It is typically used by subscription-based companies and SaaS providers.

Essentially, it's a way to average your different pricing plans and billing periods into a single, consistent number that you can track over time. By using MRR, you can evaluate the present financial health of the business and project the earnings for the future.

How to calculate MRR?

Calculating MRR is simple. Just multiply the number of monthly subscribers by the average revenue per user (ARPU).

- MRR = Number of subscribers under a monthly plan * ARPU

For instance, suppose you have 10 subscribers on the $500/month plan. The MRR will be:

(10* $500) = $5000

In the case of annual subscriptions, MRR is calculated by dividing the annual plan price by 12 and multiplying the result by the number of subscribers.

What are the different types of MRR?

MRR provides insight into the subscription behavior of customers by establishing a correlation between their account and their customers. MRR increases when new customers are acquired or plans are upgraded. MRR falls when downgrades, cancellations, and churn increase. Identifying the reasons behind the rise and fall of MRR requires tracking the factors that affect this metric separately. The different types of MRR offer different insights into revenue, customer behavior, and business health.

- New MRR

The new MRR is the revenue generated by new customers gained during the month.

- Upgrade MRR

An upgrade MRR is the amount of additional revenue generated from subscriptions that move from an existing pricing plan to a higher plan during a specific month. While calculating Upgrade MRR, add-ons associated with subscriptions are also taken into consideration.

- Downgrade MRR

Downgrade MRR refers to the reduced revenue from subscriptions that have moved from their existing plan to a lower plan during a specific month.

- Expansion MRR

Expansion MRR is the additional revenue gained from existing customers in a given month compared to the previous month. The additional revenue in Expansion MRR is generated through add-ons, upselling, and cross-selling. Positive expansion MRR shows that you were able to retain customers by gaining their loyalty and satisfaction. Due to the fact that there is no Customer Acquisition Cost (CAC) involved in these sales, these sales are great for your bottom line.

You can also calculate the rate of growth in expansion MRR for a month:

(Expansion MRR in that month / Total MRR at the beginning of the month) * 100

- Reactivation MRR

Reactivation MRR is the monthly revenue generated by previously churned customers returning to a paid plan. This represents the profit generated by regaining lost customers.

- Contraction MRR

Contraction MRR is the amount of revenue lost as a result of subscription cancellations and downgrades during a specific month. Contraction MRR will apply to customers who cancel, downgrade, pause, use credits, are given a discount, or stop recurring add-ons. Downgrades may contribute to some contraction MRR, but because other factors are involved, contraction MRR is not the same as downgrade MRR.

- Churn MRR

Churn MRR is the total amount your business loses due to subscription cancellations over a specific month.

- Net New MRR

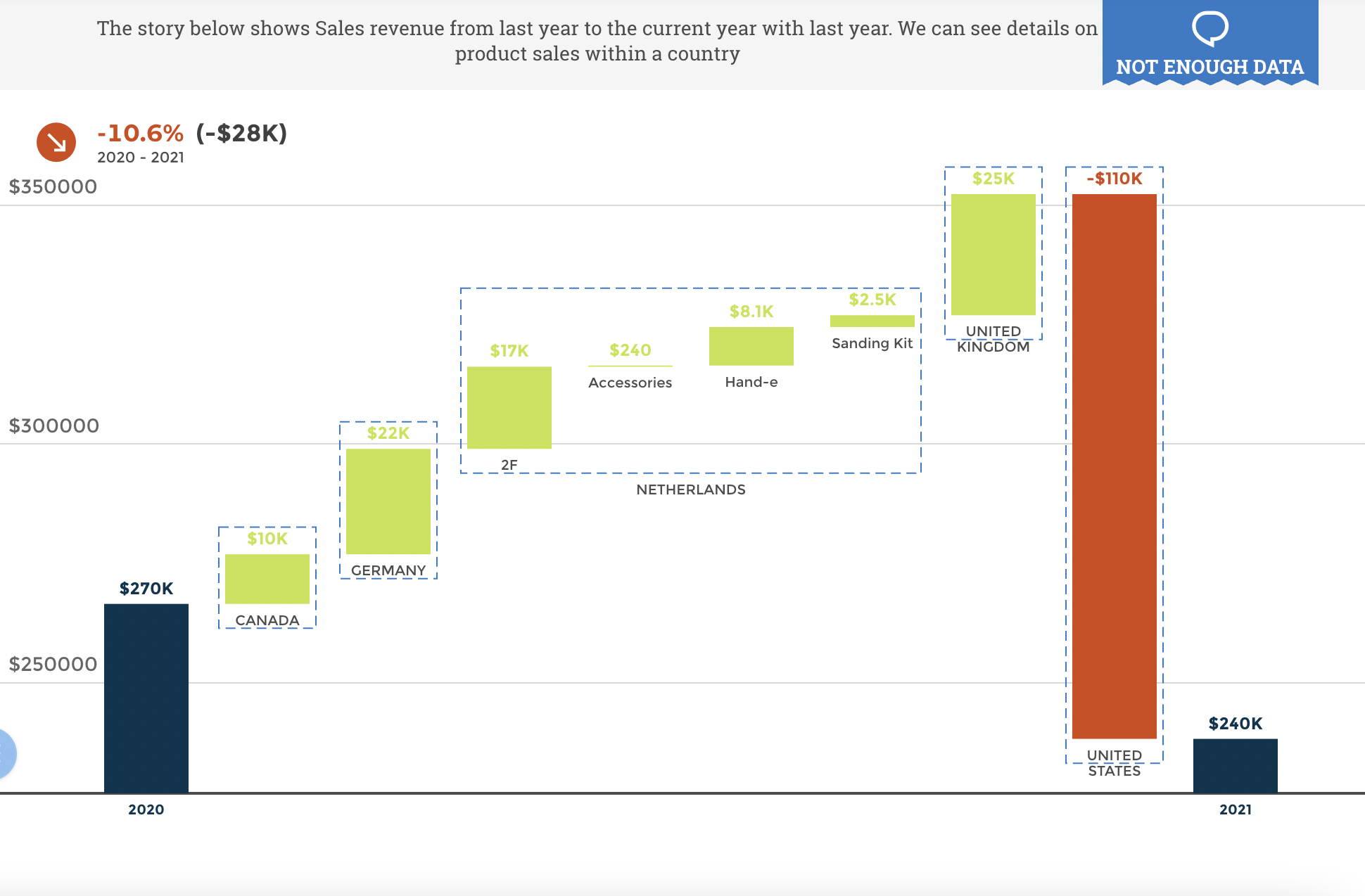

Net New MRR highlights how much your revenue has grown (or shrunk) in the present month compared to the previous month. You can calculate Net New MRR using this formula:

Net New MRR= New MRR + Expansion MRR – Churned MRR.

A negative Net New MRR indicates revenue loss. A positive Net New MRR indicates revenue gain.

Why should you calculate and optimize MRR?

Why should you calculate and optimize MRR?

In a company that's driven by recurring revenue, calculating MRR (along with similar SaaS metrics such as ARR) will give you a better picture of the company's health, help you set goals for the future, and show you how you're going to achieve your goals. MRR provides insight into:

- Post-Product-Market Fit Compass Metric

You can track growth within a SaaS organization using MRR as the main compass metric after finding the initial product-market fit through testing and activity. MRR is the purest measure of your SaaS revenue, since it shows how your revenue will change over time.

- Product team

Developing a better product will help you maintain customers, preventing MRR losses. You should incentivize your team to develop features and experiences every month to reduce MRR churn.

- Sales team

By making deals with more qualified leads and focusing on quality over quantity, your sales team can improve MRR. Net new MRR is typically the main focus of your sales and marketing teams.

- Overall financial performance

Your SaaS company's MRR is a critical financial metric, and it gives you the most accurate picture of its status. The subscription model explicitly accounts for the various "recurring" components as well as the yearly scalability of those components.

How to grow MRR

As wonderful as recurring revenue is, it can also be a major headache and eyesore for any business. Even if your team spends months improving every nook, pixel, and cranny, your MRR graph is unlikely to shift. In some cases, you may even experience a decline in your recurring revenue.

However, all is not lost! There are several things that you can do in order to improve it. Here's a list of things you can start doing today!

- Charge more

Although charging more sounds obvious, most companies are drastically underpricing their products.

It is common for founders to charge too little because they are self-conscious. The problems our companies solve don't get enough credit from us because we're afraid of rejection.

So, we charge too little to reduce the chance someone will reject us. The fact is, if you're solving any real, tangible problems for your customers, you shouldn't have to undervalue your product.

- Upsells

Increasing revenue from your existing customer base is cheaper than acquiring new ones. Both are important, but acquiring new customers is more expensive than keeping existing ones.

When your customers grow and get more value from your business over time, you should price your business accordingly. You can set this up in many ways, logistically. Let's discuss a few alternative pricing models that can help you increase your MRR.

- Per-user pricing

Per-user or per-seat pricing is one common way to attach value provided to value received. This type of pricing essentially means there's no limit to how much you could make from a given business. - Usage-based pricing

The most familiar metered or usage-based pricing comes from hosting and infrastructure companies such as Heroku and Amazon Web Services. Their services increase in price as you use them more. - Add-on pricing

Your company probably already has some base plans, but deciding ahead of time how you will "bucket" features within those plans can be a bit of a shot in the dark with no guarantee that you will get it right. By positioning your biggest features as "add-ons," you enable your customers to create the perfect set of tools. It's also a much easier upsell.

- Remove unlimited

SaaS products are difficult to price. You will have to make one of the most difficult decisions when you create any type of product, as there is no simple or straightforward answer to “how much should I charge?.”

However, you should never offer an "unlimited" plan.

There's a great chance you're already charging too little, so adding an "unlimited" plan just makes things worse. When pricing anything, it should be based on value. There needs to be a balance between what they're paying and the value you're providing, and the more value you provide, the more money you should be making.

Metrics provide useful insight into a business's performance. MRR is one of these important metrics for any subscription business. It’s key to getting a real-time financial picture of your business and making workable plans for expansion.

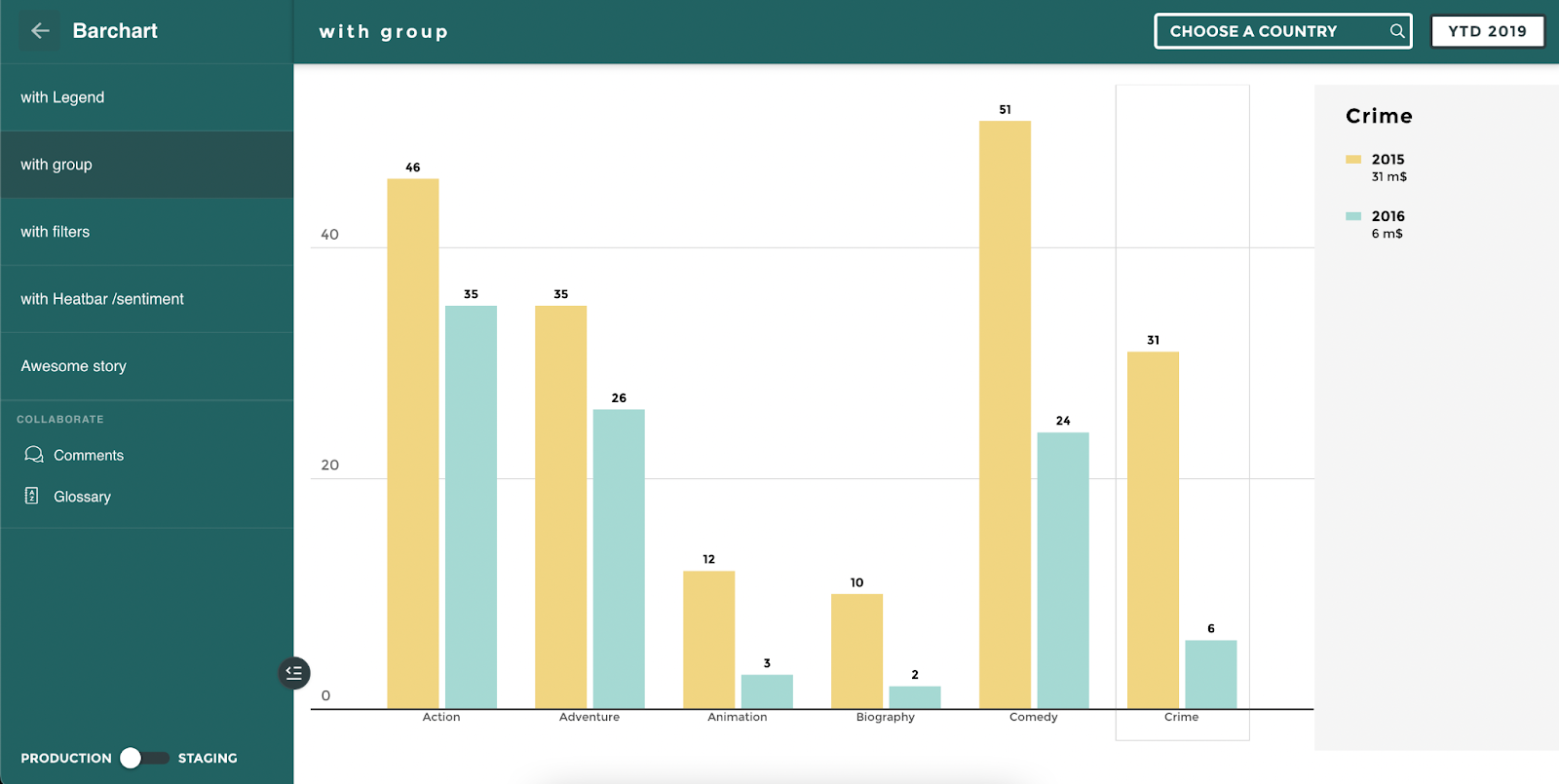

That said, in Toucan, you can monitor and track all your relevant financial metrics irrespective of your technical level. It is a 0-code platform built to be used by everyone.