Average Revenue per User (ARPU): How to Calculate and Optimize it

.png?width=88&height=88&name=portrait_agathe_face%20(1).png)

Agathe Huez

Publié le 11.02.22

Mis à jour le 13.01.26

4 min

Résumer cet article avec :

Average revenue per user (ARPU) reflects the amount of revenue a company generates per its active users. Typically, companies calculate ARPU on a monthly basis to, over time, understand how much an average customer spends on a subscription/service.

To sum up ARPU in one sentence: it's the average monthly revenue that you receive per user. ARPU is much more detailed than, for instance, a metric like MRR because it focuses on each customer's spending.

ARPU formula

To calculate your ARPU, simply divide your MRR (monthly recurring revenue) by the total number of active users you have over the course of a particular month (or other time period).

MRR / # of active customers = ARPU

Let’s look at an actual example of one of our clients with an MRR of $34,590 and 124 customers.

$34,590 (MRR) / 124 (# of customers) = $278.95 (ARPU)

Why is ARPU Important?

ARPU is often called a vanity metric (a metric that isn't actually helpful). We're not sure we agree.

ARPU can help you identify trends in customer cohorts and segments when calculated and properly analyzed. With this metric, you can identify price points and selling strategies that customers may be more incentivized by, and influence your upsell/cross-sell capabilities (all of which are important aspects of the sustainability of your SaaS business model.

Monitoring ARPU allows you to plan both for the long-term and short-term. You can use it to improve a wide variety of metrics that are strong indicators of a healthy business, including things like revenue growth (learn how to focus on, and attract, higher paying customers), and increase your Customer Lifetime Value (LTV).

What does ARPU tell you about your SaaS business?

You can use ARPU to assess current processes and make decisions about your company's future. By understanding ARPU you will learn:

- How to grow your MRR and LTV

ARPU, unsurprisingly, has a direct effect on MRR in the short run. Customers who contribute more revenue each month increase your monthly revenue intake. The long-term growth of your customer's lifetime value is also affected by ARPU; one customer's monthly revenue adds up to their lifetime value over time, so increasing ARPU increases LTV.

- How to assess the financial viability of your business

The higher your ARPU, the more quickly you'll be able to grow. Additionally, most business owners know that acquiring new customers is far more difficult than retaining existing ones. Anything that allows you to reduce your reliance on new customer acquisition is a useful tool for you to have in your growth kit. If your ARPU is low (especially in small markets), then you might not be set up for long-term success.

- How to validate your price alignment and product

A low ARPU may indicate that you are not adequately extracting value from certain buyer personas for the services you are providing. Enterprise clients, for instance, are likely to demand a lot of value from your product, which can be monetized with pricing strategies that adjust for the value that your customers are receiving.

- How to monitor the efficiency of your sales and marketing teams

In time, ARPU should increase as sales processes improve; refined pitches, value propositions, and targeting all contribute to this. You can also increase ARPU by onboarding more of the right customers and selling them the value they desire.

Segmented ARPU can also give you concrete information about popular plans and trends in cross-selling and up-selling.

How to increase your ARPU

Listed below are some strategies you can employ if you're looking to increase your ARPU and maximize your earnings:

- Adapt your pricing to attract higher-paying, long-term clients

There is no limit to the depth of SaaS pricing models, but perhaps what matters most is that successful business don't build their customer bases solely on bargain pricing.

You should be able to offer subscribers a variety of subscription plans so you don't exclude prospects with lower budgets. The "recommended" or "popular" pricing tier creates a sort of bandwagon effect that customers can take advantage of.

- Don't go free (or freemium)

SaaS providers are clamoring for forever-free plans, and for good reason. However, free plans don't factor into your average revenue per month.

You might want to examine whether or not the free service(s) you offer is doing too much at no cost if you're looking to raise your ARPU. The free tools don't necessarily have to be gutted or eliminated, but there are some small tweaks you can make to make them even more appealing.

If you're going to change features, give your users a heads-up and explain the changes. Having a list of features you can actually add to your free plans is a good idea as a sort of give-and-take.

- Offer add-ons or "a la carte" features

You are more likely to increase your LTV (and ARPU) if you give your users more opportunities to spend money on your service. That's why we're seeing a rise in SaaS companies offering optional add-ons in addition to their subscription plans.

In addition to giving customers a sense of flexibility, this strategy also creates additional revenue streams from existing customers.

- Pay attention to your most valuable accounts

You should pay attention to all of your customers. Some, however, probably deserve more attention than others.

Consider flagging tickets and questions from your largest accounts to ensure they stay around for a long time. Offering speedy, one-to-one service to these accounts can positively impact ARPU, as opposed to dedicating all of your resources to free offers. This type of VIP service can also be factored into your pricing plans.

- Optimize your ideal personas to attract higher-paying clients

Your company's customer personas dictate your targeting and, largely, your success. Maybe it's time to start looking at prospects with larger budgets if you want to upsell and increase your ARPU.

ARPU increases when you know your customers well, price correctly, and sell effectively. Talking to prospects and customers about their pain points will help you gain an understanding of the needs that your product best addresses.

- Track your ARPU to uncover trends and opportunities

Last but not least, your ARPU can't be improved if you don't monitor it. Is the graph moving upward? Downward? In either case, you shouldn't be left in the dark.

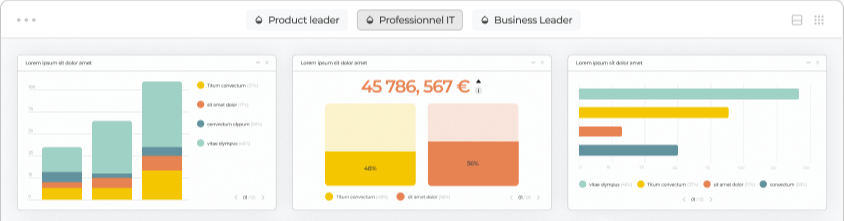

This means paying attention to your analytics using tools like Toucan.

From making more accurate sales forecasts to getting granular with your customer data, our platform breaks everything down into easy-to-read reports. Knowing your ARPU at a glance makes tracking trends and ensuring your efforts to improve it are paying off a cinch.

Toucan is a customer-facing analytics platform that empowers companies to drive engagement with data storytelling. Ranked the #1 easiest to use analytics solution by Gartner Peer Insights, their no-code, cloud-based platform cuts custom development costs with a quick and easy implementation, even for non-technical builders. To find out what our users say, read their reviews on Capterra.

.png?width=112&height=112&name=portrait_agathe_face%20(1).png)

Agathe Huez

Agathe is Head of Brand & Communication at Toucan, with over 10 years of experience in marketing, branding, and corporate communication, particularly in the SaaS and tech B2B sectors. An expert in brand strategy, storytelling, and public relations, Agathe helps businesses give meaning to their communication and showcase their expertise to clients and partners. She plays a key role in growing Toucan’s visibility and positioning as a leading embedded analytics solution, both in France and internationally. On Toucan’s blog, she shares insights on how to build impactful B2B brands, create memorable experiences, and turn data into a true competitive advantage.

Voir tous les articles