Net Revenue vs Net Income - Understanding the Difference?

It’s important for anyone involved in a business to understand the difference between net income vs net revenue. They are two critical components of assessing a business’ financial health and performance and are almost always included in the arsenal of financial management KPIs used by today’s top teams.

If you’re looking for more on net income vs net revenue, you’ve come to the right place. So…

What is net revenue?

You’re likely somewhat familiar with the components that make up a business’ income statement (think gross revenue, gross profit and net profit, and so on). Gross revenue, for instance, refers to the total money a company has made before anything is deducted for that figure (e.g. expenses).

Net revenue, on the other hand, essentially illustrates what is left from an organization’s gross revenue after accounting for costs and losses.

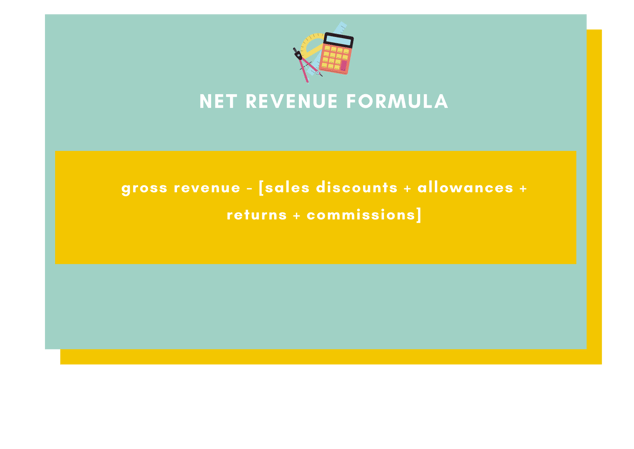

To calculate net revenue, simply subtract the following from your gross revenue:

- Any sales discounts

- Allowances

- Returns

- Commissions

The formula for calculating net revenue looks like this:

To bring this to life a bit more, the difference between your gross revenue and your net revenue essentially tells you how well your revenue generation efforts are performing. Investors, for example, are generally most interested in a business’ gross revenue because it is one of the strongest indicators of that business’ growth potential (and ability to generate sales).

Calculating gross revenue is helpful in doing things like assessing how viable your pricing model is, whereas net revenue shines more light on the efficiency of your marketing and sales efforts.

Net revenue is tremendously helpful in making cost and worth-based decisions. For example, even if a product or service is really good at generating revenue, you’ll only be able to understand whether it is actually profitable after deducting the expenses associated with it.

What is net income?

When comparing net income vs net revenue, net income can be most simplistically thought of as the bottom line of an income statement. Net income is what’s left of your revenue after accounting for all of your expenses and other allowances. In other words, it's the total amount of profit (or loss) after expenses.

The Corporate Finance Institute offers great pieces of content that dive deeper into net income.

To calculate your net income, subtract the following from your gross income:

- Cost of goods sold

- Operating expenses

- Marketing and advertisements costs

- Costs associated with interest and depreciation

- Taxes

- Miscellaneous expenses

The formula for calculating net income looks like this:

.png?width=636&name=Net%20Income%20vs%20Net%20Revenue%20Formulas%20(1).png) Net income is obviously, by now, an important metric for businesses to understand.

Net income is obviously, by now, an important metric for businesses to understand.

The last word

It’s important that businesses track net income vs net revenue to ensure they are financially healthy and set up for success. The differences between the two can uncover valuable insights, and the tracking of the figures is necessary for strong strategic and operational decision-making. It helps to understand where money is going (and where it may be better allocated), and can drive improvements such as reducing unnecessary expenses with the goal of improving profitability.