Why You Can’t Ignore ESG in Banking Anymore

.png?width=88&height=88&name=portrait_agathe_face%20(1).png)

Agathe Huez

Publié le 18.05.22

Mis à jour le 13.01.26

4 min

Résumer cet article avec :

The banking industry has been trusted by a majority of the world to fairly and safely secure global wealth since the creation of the first bank in 1472. With advancements in Fintech striving to gain the trust of younger generations, banks are innovating to fend off advances from decentralized financial systems, mainly cryptocurrency. Decentralization is the buzzword of young financial enthusiasts.

Unfortunately, this trust has been broken on multiple occasions in egregious ways. The 2008 Global Financial Crisis, which caused an estimated $2 trillion loss in the global economy, shook up the banking world. Banks clearly played a major role in this crisis, trading derivatives and handing out mortgages to sell them at a profit, even if the borrowers provided poor credit scores and high risks of default. But that was a while ago, right?

The release of the Pandora Papers late last year proved that cronyism and corruption in the banking world is still very much alive. Many world leaders were found to engage in illegal financial activity, creating shell corporations to launder money on offshore accounts. With every passing leak and release, the banking world seems to be entrenched in controversy. So, what’s the solution?

ESG as a Solution for Banking Corruption

As many experts have predicted, banking can no longer run away from ESG practices. In a world filled with scrutiny and advanced journalistic practices, banking malpractice will come to light and inevitably drive away consumers. Most importantly, corruption and malpractice create mistrust in a system that preserves the globe’s wealth.

Tracking ESG KPIs can provide a solution to major banks operating with integrity and harboring the trust of millions. By tracking these essential KPIs, banks can monitor all operations, and eventually report their efforts to the public, building further confidence in the system.

Although no standard for ESG exists in the U.S., the European Union published an ESG KPI report in 2009, recommending essential metrics to maintain environmental, social, and governance transparency. Here are some of the KPIs that banking corporations should consider tracking.

Governance KPIs

- Contributions to Political Parties

Banking firms, like any other major firm, contribute to political parties across the globe. However, these contributions can often come under scrutiny due to the favoring of one party or interest. To avoid potential conflicts of interest and a biased image, banks should report this KPI to remain transparent in the court of public opinion and diversify their contributions to fund several ESG initiatives. To measure this KPI, track the percentage of contributions to political parties.

- Anti-Corruption Prevention

Corruption, as previously mentioned, is one of the weaknesses of the banking industry, making this KPI the most important to report. Many firms around the globe send their board members and decision-makers to anti-corruption training and create robust checks and balances to avoid conflicts of interest. To track this KPI, provide transparency on the percentage of employees receiving anti-corruption training, incidents related to corruption, and initiatives within the firm to eliminate foul play.

- Loans Undergoing ESG Screening

As previously mentioned, banks fund many industries and interests that do not abide by basic ESG practices. Bank funding of fossil fuel industries has come under fire recently, with many of these firms clearly damaging the planet and violating social responsibility. Banks are called to screen borrowers to ensure that it is funding responsible ventures. To measure this KPI, track the percentage of credit loans that have undergone ESG screening.

- Funds Managed in Accordance with ESG Criteria

Banks have historically mismanaged funds to enrich certain individuals, and ESG metrics provide a check to this abuse of power. To avoid funding nefarious or damaging operations, banks vet credit lines and loans to ensure that the borrower is abiding by ESG criteria. To measure this KPI, track the percentage of total loans that have undergone ESG screening.

Environmental KPIs

- Deployment of renewable energy

Major banks such as JPMorgan Chase, Bank of America, Deustche Bank, Credit Agricole, etc. operate millions of branches globally. With governments seeking to reduce pollution and fossil fuel consumption, banks will inevitably have to make the shift to renewable energy to power their operations. Eco-friendly banks have begun to spring up globally, choosing to divert investments away from fossil fuels and operating under renewable energy. To track this KPI, calculate the percentage of energy in kWh from renewable energy sources of total energy consumed.

- Waste

Although indirectly, banks produce more waste than any other industry. Recently, banks have come under fire for not demanding supply chain changes to better the plastic pollution crisis that is impacting ocean ecosystems. By funding the plastic industry without demanding or enforcing environmental responsibility from borrowers, are perpetrating one of the biggest environmental crises of our time. By tracking waste produced by investors, banks can find ways to responsibly lend money to firms practicing ESG. To track this KPI, banks should calculate partner firms’ waste by unit produced and the percentage of waste that is recycled.

Social KPIs

- Diversity

Diversity in the banking workforce has been historically poor, catering to a white male demographic. With many independent organizations emerging that advocate for diversity in banking, banks will be expected to break this cycle. To track this metric, divide minority employees by the total number of employees.

- Restructuring-related Relocation of Jobs

Although a large shift to online banking has been occurring for the past decade, the banking industry still relies on brick-and-mortar branches for more involved requests. Because firms constantly are shuffling their real estate portfolio and relocating branches, this KPI is important to track to ensure that employees are treated fairly. To track this KPI, measure the cost of relocation, indemnity, pay-off, outplacement, hiring, training, and consulting.

Data Visualization as an ESG KPI Solution

These KPIs all provide insight, transparency, and accountability for firms willing to abide by ESG initiatives. Tracking these KPIs is no easy undertaking and cannot be done effectively or efficiently without the right tool to track and display data.

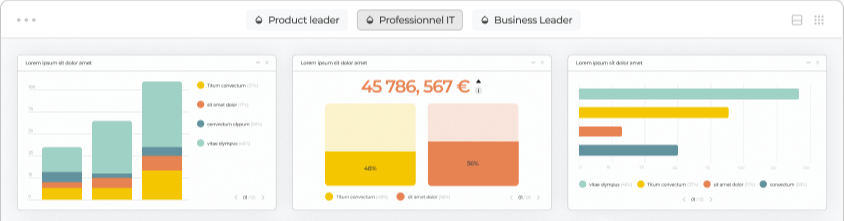

Data visualization tools that provide high personalization, optimization, and scalability such as Toucan can make your ESG data a lot more credible, impactful, and easy to understand. By involving all employees and decision-makers in a firm’s ESG journey, all departments can easily work together to create sustainable and transparent change.

Most importantly, by displaying its ESG KPIs to all employees and consumers, banks can maintain an image of credibility, justice, and non-bias. An investment in a tool such as Toucan, which portrays data through storytelling and offers glossary functionality to help non-technical users understand data, banks can tell their ESG story in a quick, efficient, and readable manner, ultimately attracting more consumers who are unhappy with their banks’ malpractice.

.png?width=112&height=112&name=portrait_agathe_face%20(1).png)

Agathe Huez

Agathe is Head of Brand & Communication at Toucan, with over 10 years of experience in marketing, branding, and corporate communication, particularly in the SaaS and tech B2B sectors. An expert in brand strategy, storytelling, and public relations, Agathe helps businesses give meaning to their communication and showcase their expertise to clients and partners. She plays a key role in growing Toucan’s visibility and positioning as a leading embedded analytics solution, both in France and internationally. On Toucan’s blog, she shares insights on how to build impactful B2B brands, create memorable experiences, and turn data into a true competitive advantage.

Voir tous les articles