Today’s emerging technologies combine AI, automation, and retail data analytics to yield insight, improve ROI, and reduce operational costs.

In this article, we will discuss more how to de-compartmentalize the financial function in retail-oriented companies so that leaders can streamline and improve management. We will tackle the need for the digital transformation of financial services, steps to take to get started, as well as the benefits lying ahead for driving flexible, agile growth for your retail business.

Acknowledge the importance of lean finance functions

Efficient financial management is one of the most challenging parts of running a business in the retail sector.

Starting from the smallest brick-and-mortar store all the way to the biggest online marketplace, most of these struggles are related to managing accounting, analyzing revenue and business expenditures on a granular level, ensuring transparent data analytics across all departments, while at the same time exceeding customer expectations and ensuring ROI growth.

The backbone of any retail company is the financial department. According to a study performed by Accenture earlier this year on 700 CFOs from 82 retail businesses, 85% of interviewees pinpointed that proper analysis of financial data is critical to adding new value to their business. At a global scale, finance teams are accountable for the way subsequent sectors function; including marketing, sales, and HR.

To achieve high performance, a strong foundation is needed. Therefore, finance functions must be properly aligned to improve the efficiency and coherence of core activities, and enable unified reporting standards, reliable data streams, and properly optimized financial processes.

Implementing lean finance functions involves decluttering and simplifying fundamental finance processes to drive effectiveness. This demands a thorough review of all transactions and financial reporting activities.

The focus should be on crafting a unified structure for common activities involving the collection, verification, classification and processing of the data to improve the management of your retail activities.

Prior to making a choice and settling on a tool or platform, assess your options carefully. The variety of retail analytics software solutions is vast, and oftentimes, quite overwhelming.

Look for an interactive data visualization solution that can help you share and distribute your data across multiple departments seamlessly; and always remember your end goal: to increase sales while reducing costs.

Leverage the power of digital to build a digitized foundation

Many of today’s retail companies – regardless of size – lack digital basics like a digital-oriented workforce, automated tools, and the ability to implement retail finance analytics the right way into their business model.

This way, the finance function is stuck with slow, old-fashioned legacy systems that don’t – better said, can’t – collaborate with each other. In the absence of integrated data, there’s no way of detecting and responding to business changes fast and in real-time.

Digital technologies have the ability to reshape the finance function of a retail business with improved planning, better cost management, and properly aligned processes. To attain value, a digital strategy and framework must be set in place. American luxury brand MZ Wallace jumped on a digital transformation journey that helped the company reach a 180% yearly growth in sales.

“We invest in digital first, whether it’s technologies, marketing, or our people. We’ve grown our team by 48% in the last year […] Everyone in the company has a well-rounded perspective of our current digital practices, and we provide them with the best technology available”, highlighted Kevin Mogyoros, CFO & COO of MZ Wallace.

Before going digital, the first step is to build a digitized foundation. Start by deploying advanced digital tools that can improve the efficiency and performance of the finance function. Automation & robotics, data visualization, and advanced retail data analytics – for both finance and the business in general – are fundamental tech stacks that need to be looked at, analyzed, tested, and implemented to:

- Improve overall management of retail-oriented activities

- Benefit from dramatic improvements in performance

- Uncover hidden opportunities for growth

- Accelerate decision support and come up with demand models that can improve inventory management and working capital

Financial department : Boost organizational performance via data visualization

Following your decision to leverage the power of digital to build a digitized foundation, the next step is to boost organizational performance. In order to make sensible resource-allocation decisions, your team needs real-time information. Often times, financial departments lack the data necessary to optimize processes because of reasons like:

- Data formats are incompatible

- The data cannot be shared between teams

- Lack of data availability

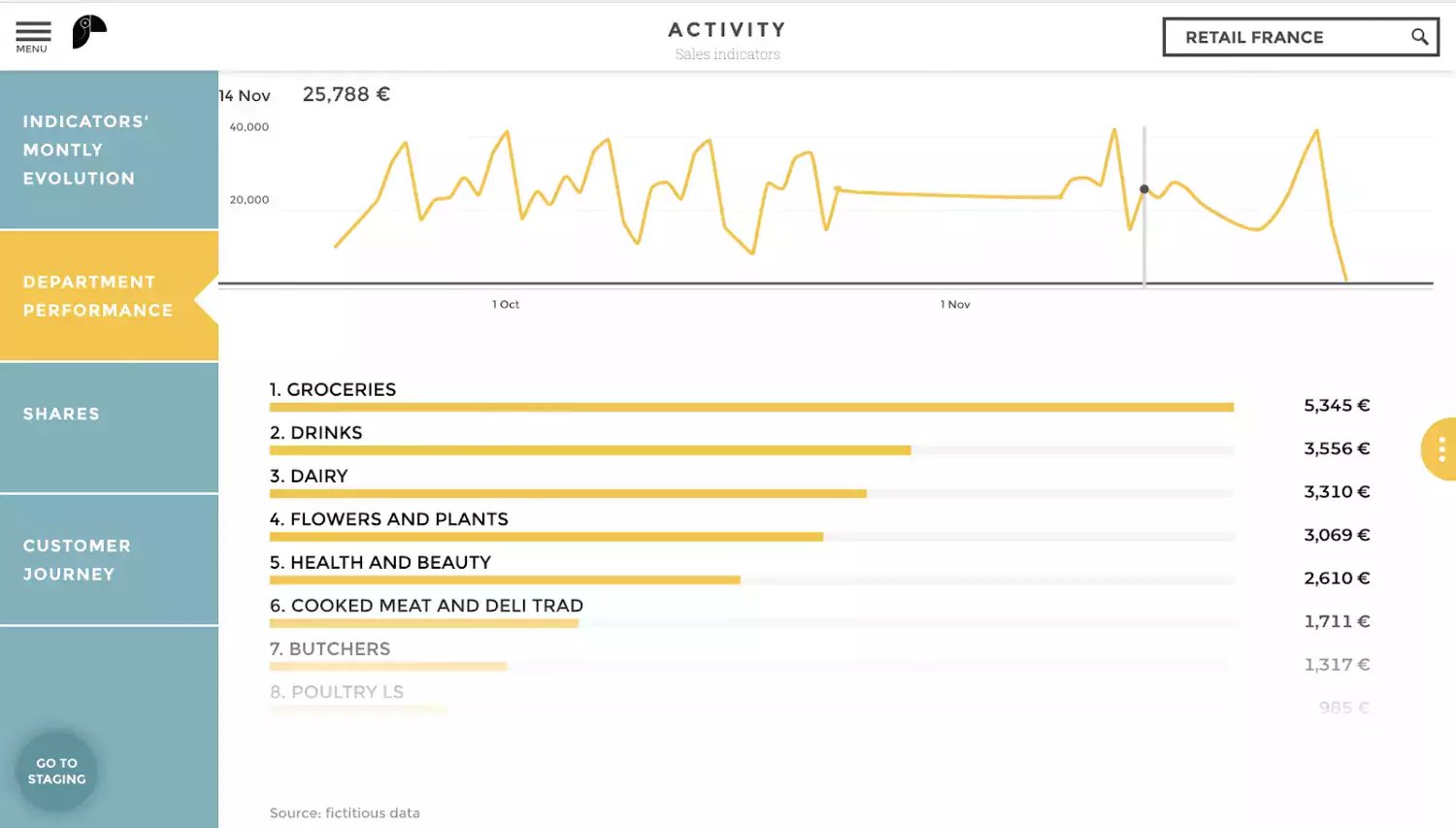

To create actionable business reports, your team needs to leverage data visualization tech stacks and pair them with automation capabilities to push the right information, present it in an intuitive format, and foster aligned business discussions. A central repository that allows real-time updates of the information should be made available for other departments within the company to get easy access to.

CFOs must collaborate with both CEOs and IT to decide on the right data visualization tools. The end goal is to restructure end-to-end financial processes like order-to-cash, data-to-report, purchase-to-pay processes, and reconfigure them by implementing a user-focused, visually-appealing approach.

Establishing rules and regulations around the use of data is equally important. Although the information must be available for everyone in the company, at any time, from any device, and from any place, centralization is fundamental to ensure data security.

Build value with advanced retail finance analytics

We live in a tech-driven world where companies across all industries are fighting to get a competitive advantage using advanced data analytics to pull out critical business data and improve strategies with unique insights. In the retail sector, the competition is fierce, and many businesses have realized that building true value can only be done with advanced, customer-oriented data analytics.

Global industry report predicts that big data analytics in retail will increase from $3.45 billion in 2018 to $10.94 billion by 2024. For the timeframe mentioned, the registered CAGR would be 21.20%. To get ahead of the curve, big data technologies and advanced retail data analytics are critical to stay competitive.

The same report mentions that fashion retailer H&M has already made a move in this direction by implementing algorithms to gain better insight from receipts, loyalty cards and returns to boost its bottom line. Walmart has jumped on a digital transformation journey, too. According to the mentioned report, they’re in the process of developing “the world’s largest private cloud system with an estimated management capacity of 2.5 petabytes of data per hour.”

The time for CFOs to understand the power of advanced analytics is NOW! To ensure a smooth transition between the old and the new, they must collaborate closely with CEOs and managers to identify loopholes within the company, as well as specific areas that must be improved.

Whether it’s optimizing pricing, preventing fraud, identifying customer churn, or exploring with the variety of tech stacks available – it all begins with rethinking the finance function to better organize cash flows, speed slow reporting, enable agile data transmission, and upgrade collaboration between different teams.

The need to streamline and de-compartmentalize the finance function in retail has become acute. But in spite of the digitalization opportunities available, skepticism abounds. Unfortunately, a one-size-fits-all solution doesn’t exist because every company has different needs and expectations. To keep up with the pace, finance professionals must consider replacing outdated, traditional operating models with more flexible ones, capable of deploying critical resources to tackle the biggest challenges.

The focus should be on integrating agile business operations to improve profitability, working capital, collaboration with both distributors and suppliers, and operational outcomes to increase ROI. Most of the challenges revolve around reducing costs and accelerating revenue. To overcome them, the change should start by acknowledging the importance of a lean finance function; revamping current strategies by adding real value with reliable retail data analytics that can generate accurate forecasts, helping other teams within the company to improve management of their retail activities and boost business performance.