Quick Ratio - What is it?

The quick ratio, often referred to as either the “acid-test” or “liquidity ratio”, is an indicator of a company’s short term liquidity. Put simply, the quick ratio measures a business’ ability to pay its short-term obligations with assets it owns that can be easily converted into cash (marketable securities, accounts receivable and, yes, actual cash).

The quick ratio therefore measures the ability of a business to pay off the aforementioned obligations, or liabilities, without needing to either sell it’s inventory/services or to secure any additional financing. The higher the quick ratio is, the better a company’s liquidity and, subsequently, financial health. A lower ratio, on the other hand, indicates that a company may struggle to pay off its current debts.

The quick ratio generally incorporates all current assets except for two: a company’s prepaid expenses (because they can’t be used to pay off any other liabilities) and it’s inventory (because it may take too long to convert that inventory into readily available cash).

Difference Between the Quick Ratio and the Current Ratio

The quick ratio is often viewed to be a more conservative measure than the current ratio. The current ratio includes all current assets that can be used to cover current liabilities, whereas the quick ratio excludes, as we mentioned, things like inventory and other current assets. Why? These things are generally more difficult to convert into cash. The current ratio, for example, considers inventory and prepaid expenses to be assets, but something like inventory takes time to liquidate.

Making Sense of the Quick Ratio

Put simply, the quick ratio is a way to measure the dollar amount of liquid assets at an organization weighed against the dollar amount of that same organization’s current liabilities.

A quick ratio of 1 is often considered to be “normal” as it indicates that an organization has just the right amount of liquid assets to cover its current liabilities. A quick ratio that’s less than 1 means that a company may not be able to pay off its current short-term liabilities. If the quick ratio exceeds 1, that means a company can instantly pay-off its current liabilities.

As with most other financial ratios, it's important that the quick ratio is analyzed and viewed alongside others because, in isolation, it doesn’t necessarily provide a comprehensive picture of the financial health of a business. To get a more holistic view, make sure you are considering other associated measures.

Quick ratios can be improved by converting more of an organization’s net profits into cash, cash equivalents, and/or marketable securities. Similarly, any reductions in liabilities (achieved by reducing expenses and repaying debts) will also have a positive impact on the quick ratio. If a quick ratio is considerably higher than “normal”, a business can invest extra quick assets into projects that serve to grow the business or improve organizational efficiency.

How to Calculate the Quick Ratio?

There are two ways to calculate the quick ratio:

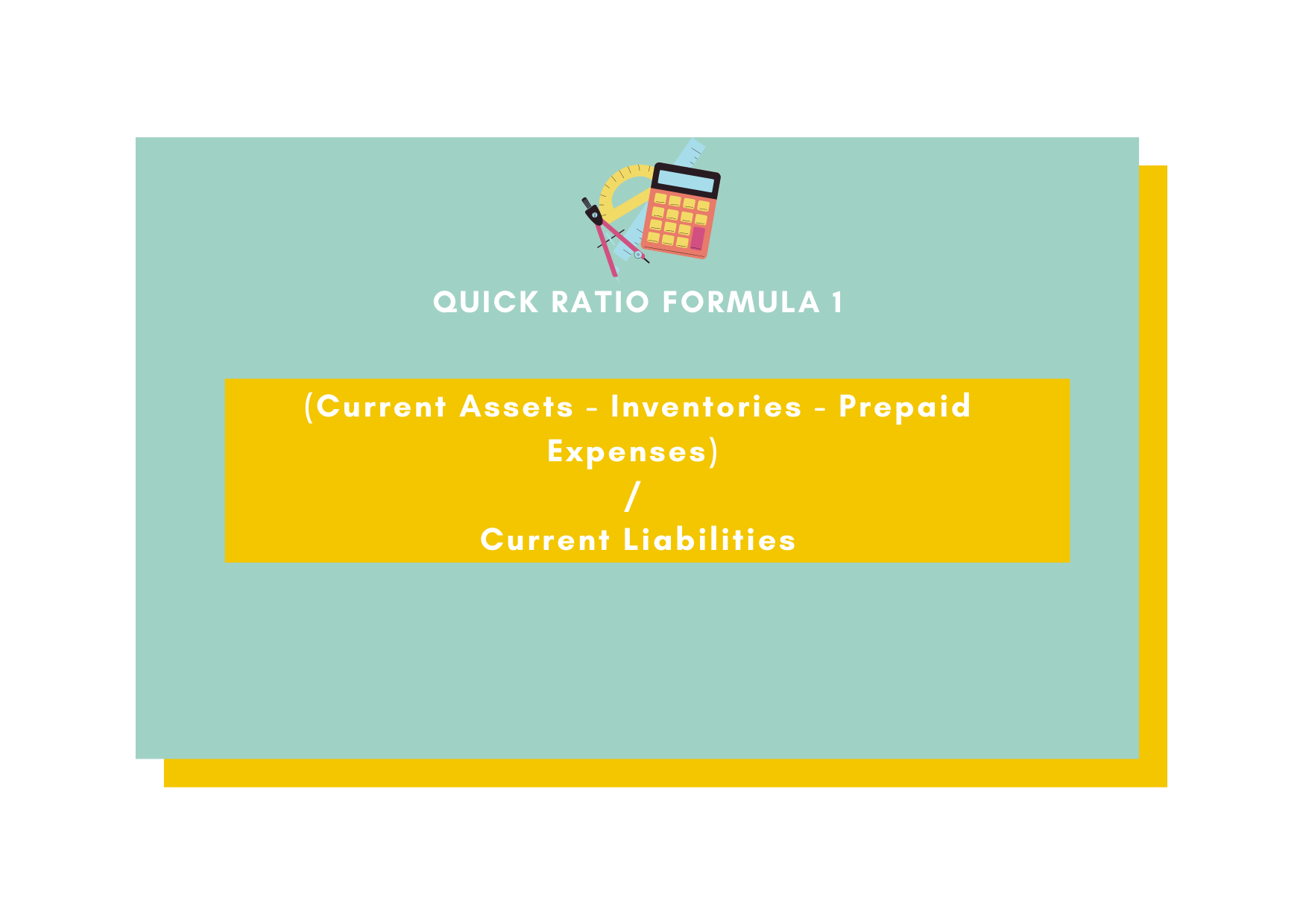

Method 1: Quick Ratio = (Current Assets - Inventories - Prepaid Expenses) / Current Liabilities

Method 2: Quick Ratio = (Cash + Cash Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

All of the components listed above can be found on a standard balance sheet in the sections that list current assets and current liabilities.

The first ratio focuses more on line items that can’t be rapidly converted into cash (again taking inventory as an example, selling it off rapidly might necessitate large discounts on their selling price).

The second ratio is similar to the first, but concentrates on the “quickest” assets. That is to say the ones that can be quickly converted into cash.

The liquid assets involved in the calculation should only include assets that can be converted to cash in the short-term. “Short-term” usually means within 90 days (e.g. only accounts receivables that can be collected within that time frame should be added).