Net Profit Margin - Why is it Important?

Revenue and profit metrics are the most vital aspects of an organization's financial operations. Net profit margin is arguably the most important in diagnosing weaknesses or verifying success.

What is Net Profit Margin?

Simply put, net profit margin measures a company's net income as a percentage of revenue. It is usually expressed as a decimal or fraction of revenue since it measures the percentage of each revenue dollar translated into profit for a given time period. For example, if a company generates a 10% net profit margin, every 0.10 cents on the dollar is profit.

How to calculate Net Profit Margin?

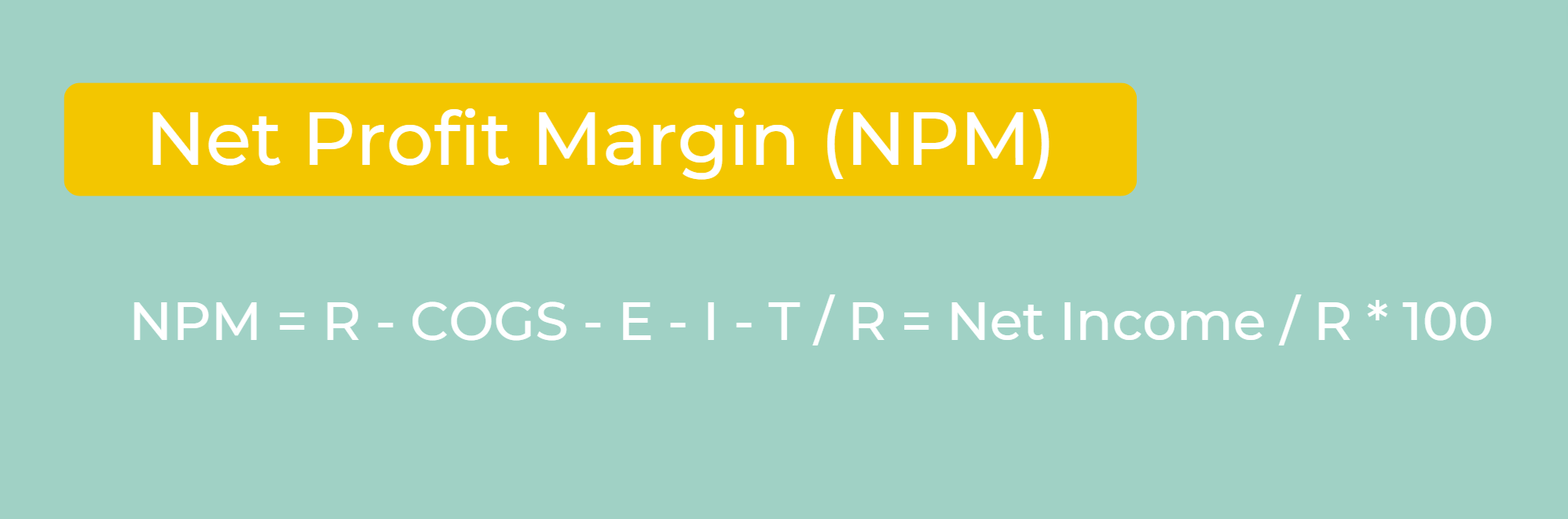

The formula to calculate this metric is as follows:

Here is a breakdown of the variables:

- R = revenue

- COGS = Cost of goods or services sold

- E = Operating and other expenses

- I = Interest

- T = Taxes

Once you've identified all of the variables on your income statement, insert them into your equation to find your net profit margin.

Why is Net Profit Margin important?

Net profit margin includes many factors in an organization's operations, reflecting a full assessment of efficiency and performance. Net profit margin takes into account:

- Total revenue

- Any other income streams

- Cost of goods/services

- Operational expenses

- Interest expenses

- Debt

- One-time payments

Because this metric encompasses so many aspects of a company's financial health, it is a vital signal to investors and C-level executives. Organizations usually generate a net profit margin at the end of the quarter or financial year, reporting to all stakeholders and employees.

An excellent net profit margin will usually hover around or over 10%. If a business generates 9% or less, a trimming of expenses is necessary to maintain financial stability.

It is important to remember, like with any financial metric, that net profit margin has its limitations. It is possible to trim an asset portfolio to temporarily boost profits, although growth and sales may be stagnating. It is important to cross-reference other metrics such as gross profit margin and net operating income.