#1 Rating

for ease-of-use

Track

your most important metrics

Forecast

quicker, better, faster

.webp)

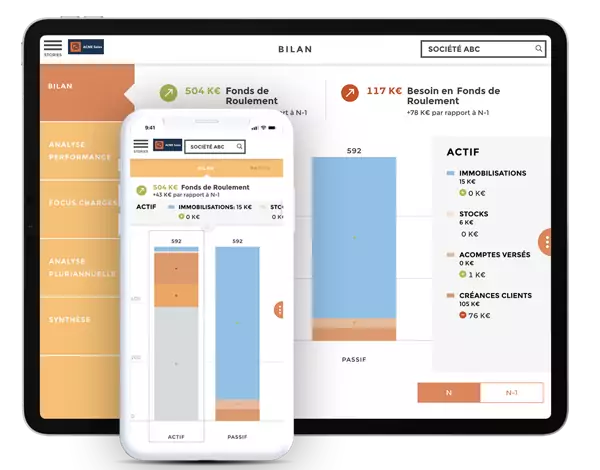

Improve your decision-making

- Quickly turn complex financial data into actionable, real-time insights.

- With analytics that are updated automatically, beautifully visualized, and highly shareable, you can make better decisions about your investments, future business goals, and short and long-term strategies.

- Deploy analytics in a matter of days or weeks, with no custom development (aka additional resources) needed to create and maintain them.

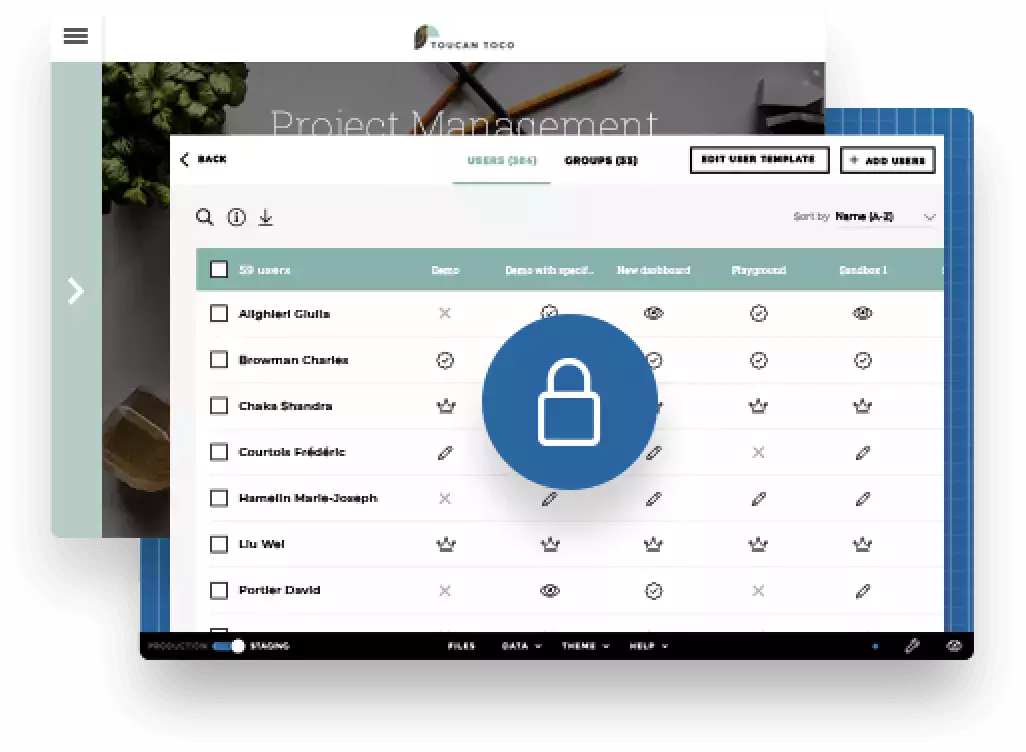

Have confidence that your critical insights are secure

-

Safeguard all your sensitive financial information with on-premise deployment, cloud deployment, or both.

-

Set permissions at any level so that your users only see what they need to see.

- Leverage Toucan's highly flexible authentication protocols to fit any situation.

Empower your end-users

- Empower any user with actionable insights, delivered in real-time and on any device

- Make sure the right people get the right data in the formats they prefer

- Engage with intelligent alerting, ready-to-use apps, built-in story creation tools, and best-in-class visualizations.

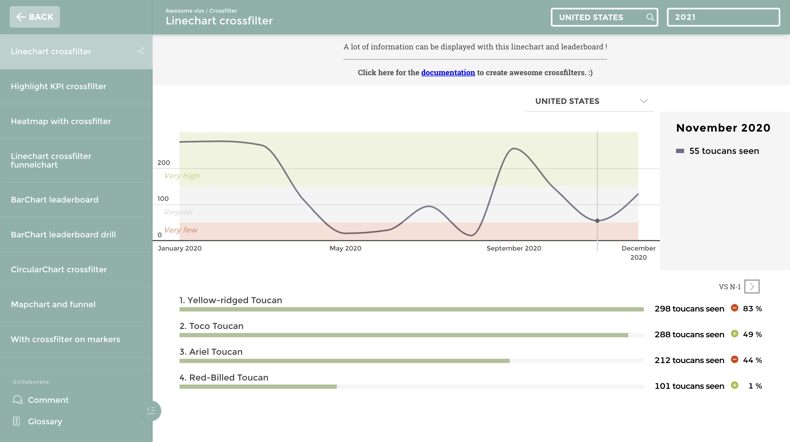

Explore Toucan on your own

Discover all the charts variations, data storytelling features and more!

Customer Stories

We used to need an hour to prepare an ExCo meeting. Today we spend 10 mn on the app, and 45 mn on debates and actions.

Jérome Lebon - Crédit Agricole Alpes Provence, General Manager

Ready to get started? Experience data stories