I am constantly bombarded with newsletters telling me how to raise money, how to create the ideal pitch to attract investors, etc. Having dinner with longtime friends who are also entrepreneurs, the conversation will often lead to them proudly flaunting their fundraising efforts, even comparing how much money they’ve raised. The worst part is that their startups no longer exist, having either been absorbed by their investors or sold for scrap to another company once all of the money was used up.

It’s too bad that profitability doesn’t have this kind of success in the startup ecosystem, whether in the media or among founders or teams. Raising money has become a sort of Holy Grail.

Fundraising and revenue growth are frequent topics of discussion, but we never hear about profitability. It’s as though making a profit is no longer viewed as a priority. How many startups do we see trying to raise money before they set the foundation for a successful product?

Don’t get me wrong. There are many good reasons to seek out investments. Nonetheless, I’d like to point out some of the issues that can arise when startups raise funds too early.

Raising funds is a means, not an end

Everyone has heard this before, but it still seems like the success of a company is no longer measured by how well its business model is working. That’s really too bad. Raising money is not an end in itself. Ever. It’s a means of securing financing. A way to go faster. But it’s not a distinct marker of success.

Ask Jawbone, a unicorn that raised nearly 1 billion dollars, was valued at several billion, and is now going out of business. Their business model was no longer centered on selling their product, but on raising more funds. This went on for 17 years until their lack of profitability caught up with them.

A mistake often made by new entrepreneurs is thinking about all the things they could do with a bigger budget. “Oh, if I only had X million, we could develop this product or do that media event.”

But if you can’t do it with what you currently have, it’s either the wrong time, or it’s not useful Also, it’s probably not a couple of million more that could help you make your product or service more viral, more appealing or more relevant for your customers.

Raising money is a tool to help you grow, and this tool should be used to create more value and profitability. Not to offset the costs of renting unnecessarily large facilities, hiring overqualified employees or boosting a business model that doesn’t hold up. This doesn’t, however, include companies that require a significant initial investment, such as those in the pharmaceutical industry, research, manufacturing, etc.

Don’t raise money to compete with other companies

A startup is created to solve a problem that other companies have not addressed yet. A startup is meaningful when it offers something new, something that does not yet exist on the market.

If a company has to rush to raise money quickly so it can beat the competition, it means that its product is not revolutionary. In this case, wouldn’t it be better to pivot towards a different ecosystem with no competition?

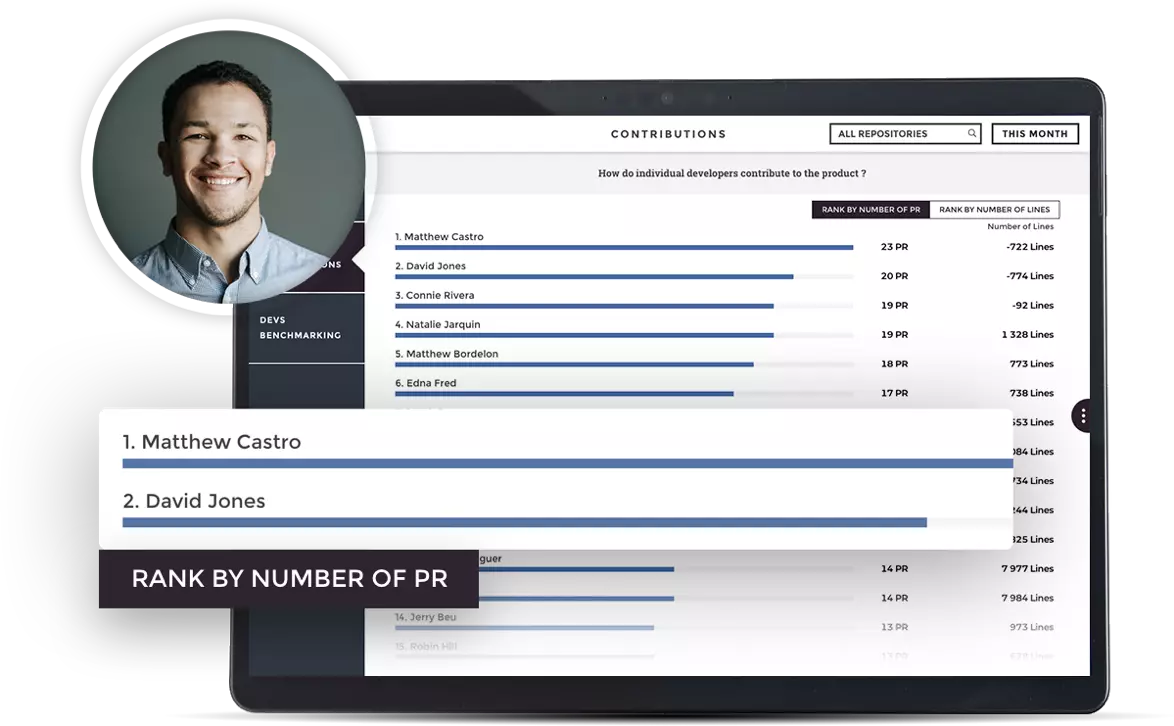

Toucan Toco is often compared to other software giants at first, but we’ve actually taken a new approach to the BI market that has existed for 40 years. Our data storytelling platform is a new .category in this field, meeting a need that no other company has addressed.

We wouldn’t have had a chance if we had offered the same product as our “competitors”, only better. We would have been trying to meet a need that had already been addressed by these .untouchable businesses, who would have had far more expertise and experience than us.

Startups that have raised money fail more frequently due to a lack of funds than bootstrapped companies.

Kerry Jones, a marketing researcher at Fractl, analyzed reports from more than 150 founders on ”why their startups failed. In the field, this is called a “postmortem”. She noticed two key trends.

It was the startups that raised money who reported failing due to a lack of additional funding – around 30% of the 150 startups studied.

Additionally, for startups that raised more than 10 million, 19% of these stated that they failed due to being outcompeted. This clearly shows that their business model was too similar to those already on the market.

TechCrunch also published a list of the 10 startups that raised the most funds who later went out .of business – funds invested in these totaled more than 1.7 billion dollars

On the contrary, these reasons are rarely seen among bootstrapped startups as key reasons for failure among the 150 startups studied. Source: Fractl

Raising funds can distance founders from their product

When a startup is launched, founders should ideally play a hands-on role, advancing the product and the company and boosting its growth. Raising funds, though it may address growth-related challenges, does not leave founders the necessary time to ensure their business model is in line with their market.

In order to secure the next round of funding, some startups might focus on growth metrics in order to persuade potential investors.

The problem is that some startups might focus only on these indicators in order to obtain more funding, shifting their focus away from generating a profit and developing a viable business model.

In addition, most startups are founded with a small team of less than four people. Allocating resources to this is truly non-negligible for a company’s development. If one of the founders is not fully present, that can present a real shortfall.

Finally, there’s the question of personal development. Setting aside time to raise money makes the founder a better fundraiser, of course, but not a better CEO. Spending that much time away from their main tasks while their product is not yet stable is sure to steer the company in the wrong direction.

It’s possible to get addicted to raising funds

CBinsights, a venture capital research center, shared an interesting study on 1098 startups in the US that raised money between 2008 and 2010. Nearly half (46%) of these startups raised at least two rounds of funding. Even more impressively, 28% of companies that raised funds were either acquired or did an IPO.

These figures say a lot. Here’s what they suggest: once you’ve raised funds, your investors have no .interest in seeing you take your time to grow your business autonomously. Why? Because your investors want a return on their investment. This is normal.

If a second round of funding is raised, their shares in your company will be valued higher. In the case of an acquisition or an IPO, they’ll also have a strong return on their investment.

Raising funds means entering into a long-term partnership, it’s not simply an increase in cash flow. You’re no longer the captain of your ship, and you’ll have to meet expectations in terms of hiring, marketing expenses and increase in turnover. Your investors are inextricably connected to your company.

Raising funds to speed up growth

Fundraising must not be used in place of a plan to generate profit. A startup that does not have the necessary foundations and frameworks to set this in motion should never raise funds. I can only recommend waiting, setting up your teams and introducing your product to the market.

Toucan Toco will most likely turn to investors to help boost growth. However, we will do so after having tested our processes in-house, and having a clear idea of where we are going. I’d rather make a mistake with 100 000 well-invested euros than with 3 million.

Our growth has always been natural and well-managed. This has not kept us from doubling our turnover every year and having a team of 50 people in 3 years. By taking our time and building a solid foundation for our business, we are able to go even faster than we could have if we had raised money.

A company’s ability to find clients and develop solid strategies for pricing, product-market fit and profitability, all without raising funds, shows that the company’s foundations are strong, and they’ll be able to grow exponentially when funds are eventually invested.

One more piece of advice: fundraising is a partnership, and as in all partnerships, it is the people that count. Develop a strategy that meets your needs. Are you looking for cash flow? For investors that will participate in the operational aspects of the company? Make sure that you’re on the same page as your investors. This is a problem that is seen far too often with young startups.

The choice should not be essentially based on the amount of money being raised, but rather on the quality of the partnership, on a mutual understanding between the founders and the investor. They should share a vision and a common goal. This strategy might be to exit in two years, or to aim for a long-term, large-scale project like Airbnb or Facebook. In each of these cases, you would make different choices in terms of partnerships. There’s only one rule – take your time, and you’ll save time later.

.png)