Recurring Revenue - What it is and How to Calculate it?

Recurring revenue refers to the proportion of a business's revenue that is expected to continue in the future. Recurring revenue is dissimilar from one-off sales events. Recurring revenue is more predictable and stable, as it reoccurs at regular intervals.

Recurring revenue generally leads to positive business outcomes such as higher revenue predictability, higher gross and net profit, and increased stability. When total revenue is made up largely of recurring revenue sources, teams are better able to plan and estimate their business value and are more attractive to investors.

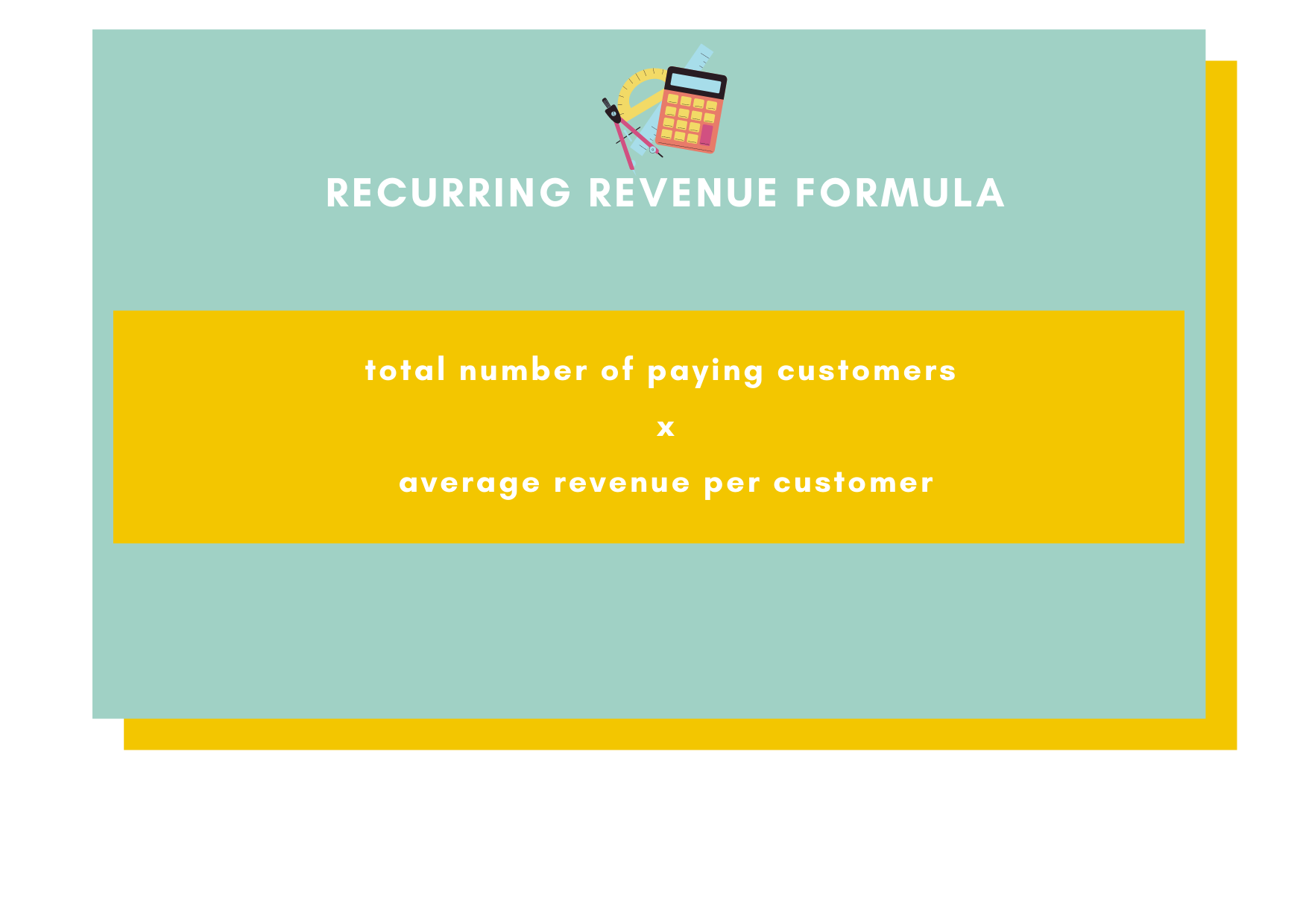

How to calculate recurring revenue

Though the way in which organizations calculate recurring revenue will change from use-case to use-case, the calculation is standardized in the sense that it is always comprised of the overall number of paying customers and the average revenue per customer. Here’s an example of what that formula might look like:

More on recurring revenue

It’s probably obvious that everyone, from employees to investors, will pay close attention to a business's revenue as an indicator of performance, potential, and a litany of other important things.

Revenue, however, consists of both recurring revenue and the one-off sales that we touched on earlier, and recurring revenue is often particularly (if not more) important as it is a better indication of whether a company will be able to maintain consistent growth, profitability and, ultimately, long-term success.

Recurring revenue, especially from an investment perspective, is therefore highly desirable. Recurring revenue can come in many different forms and varies from company to company, and especially so from industry to industry.

In the SaaS industry, for example, recurring revenue can come from customers who subscribe to a service in the form of long-term contracts that are renewed or increased annually. Companies with these set-ups are able to confidently record future revenues because of the legally-binding nature of those contracts. While those revenues aren’t guaranteed per se, they’re highly likely to be incurred. So, while cancellation and opt-out clauses are generally the norm, organizations are still able to forecast (with relative accuracy) how many of their customers will stay with them for the duration of their agreed-upon terms.

Other forms of recurring revenue include, but aren’t limited to:

- Rent:rental income from long-term rentals or leases

- Leasing: income from cars (or other vehicles), equipment, and the like

- Support contracts: income realized from contracts in, for example, the software industry where services are sold with things like support fees baked in as an additional, renewable cost

- Loyal customer bases: while this might not intuitively be recognized as a form of recurring revenue when companies (especially well-known brands) have a broad and loyal customer base, they often consider those with predictable purchase patterns to be recurring revenue. A good example of this would be Coca-Cola.

You can find more examples of types of recurring revenue in this article from Simplicable.