In simple terms, burn rate measures how much capital your business needs to cover all expenses in a certain period of time, usually a month. Generally, burn rate is used to determine how quickly a company will go through its startup capital before becoming cash flow positive. It is one of the most important financial KPIs to monitor for a startup.

A low burn rate indicates the investors' investment dollars will go further when a new business applies for startup capital. The chances of new businesses gaining traction and becoming profitable are higher with a low burn rate, thus yielding a higher return on investment.

Well-established businesses also rely on this metric. The lower the burn rate of your business, the more likely it will survive a low-revenue quarter. An indication of a healthy business is a low burn rate, which corresponds to a strong cash position. Despite being profitable on paper, a company can still fail due to a lack of cash. You can avoid this by having a low burn rate.

How to Calculate Burn Rate

- Gross Burn Rate

Gross Burn Rate is a company’s operating expenses. It is calculated by adding up all the expenses the company has, such as rent, salaries, and other overhead, and is often calculated monthly. In addition, it provides insight into a company's cost drivers and efficiency, regardless of revenue.

Gross Burn Rate = Cash / Monthly Operating Expenses

- Net Burn Rate

Net Burn Rate is the rate at which a company is losing money. This is calculated as the difference between the company's operating expenses and its revenue. The calculation is done on a monthly basis. It reveals how much cash a company needs to continue operating for a period of time. One factor that must be controlled, however, is the variability of revenue. The fall in revenue without a change in costs can result in a higher burn rate.

Net Burn Rate = Cash / Monthly Operating Losses

Burn Rate Example

A company's net burn is the total amount of money a company loses each month.

An engineering startup that spends $10,000 per month on office space, $20,000 on equipment maintenance costs, and $30,000 on salaries and wages would have a gross burn rate of $60,000. On the other hand, if the company already had revenue, its net burn would be different. Even if the company operates at a loss, with revenues of $30,000 a month and costs of goods sold (COGS) of $10,000, it would still work to reduce its overall burn.

In this scenario, the company's net burn would be $40,000, derived as:

- $30,000 - $10,000 - $60,000 = $40,000

This distinction is very important because it impacts a company's bank account and, thereby, its runway for growth. Even if it's spending $60,000 gross, the actual amount it is losing per month is $40,000. Therefore, if it had $200,000 in the bank, its runway would be five months rather than around three months. It determines how the managers outline the company's strategy and how much an investor will want to invest.

What are the Implications of a High Burn Rate?High burn rates indicate that a company is depleting its cash supply rapidly. There is a high likelihood that it will enter a state of financial distress. Considering the set amount of funding, investors may need to set more aggressive deadlines for revenue realization. Alternatively, it may mean investing more money into a company in order to extend the time it takes to reach profitability and realize revenue.

How to Reduce Burn Rate?

- Layoffs and Pay Cuts

If a company is experiencing a high burn rate, an investor may negotiate a clause in the financing agreement to reduce staff or compensation. It is common for large start-ups to lay off employees when they are trying to streamline their strategy or when they just signed a new financing deal.

- Growth

It is possible for a company to project growth that will improve its economies of scale. Consequently, it can cover its fixed expenses, such as overhead and R&D, to improve its financial position. Many food delivery start-ups, for example, are losing money. However, growth forecasts and economies of scale entice investors to further fund these companies in hopes of profitability in the future.

- Marketing

Many companies invest in marketing in order to grow their user base or product usage. Startups, however, lack the resources to use paid advertising, making it difficult for them to succeed. A growth strategy that is not reliant on expensive advertising is called "growth hacking" by start-ups. As an example, Airbnb's engineers reconfigured Craigslist so that traffic from Craigslist would be directed to its own site.

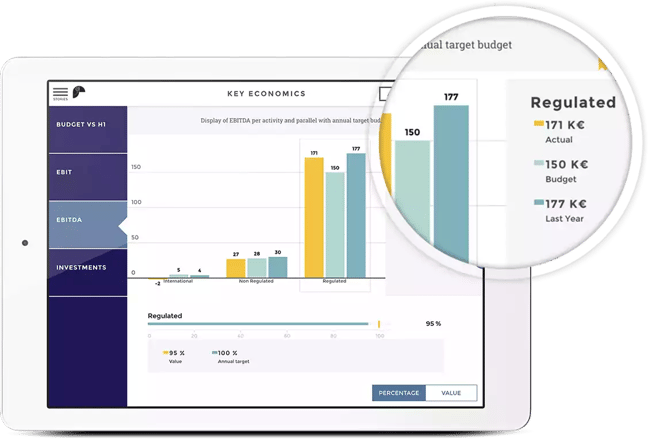

It isn't difficult to calculate the burn rate in your business. Although it can be uncomfortable to admit that you have a high burn rate (and a limited cash runway), it is far better to address these metrics before they become a problem. Burn rate isn’t the only important metric companies need to keep an eye on there is a wide range of financial KPIs. For this, you need a good analytics dashboard that can display them at a glance, give you actionable insights and can be used by everyone in your organization.